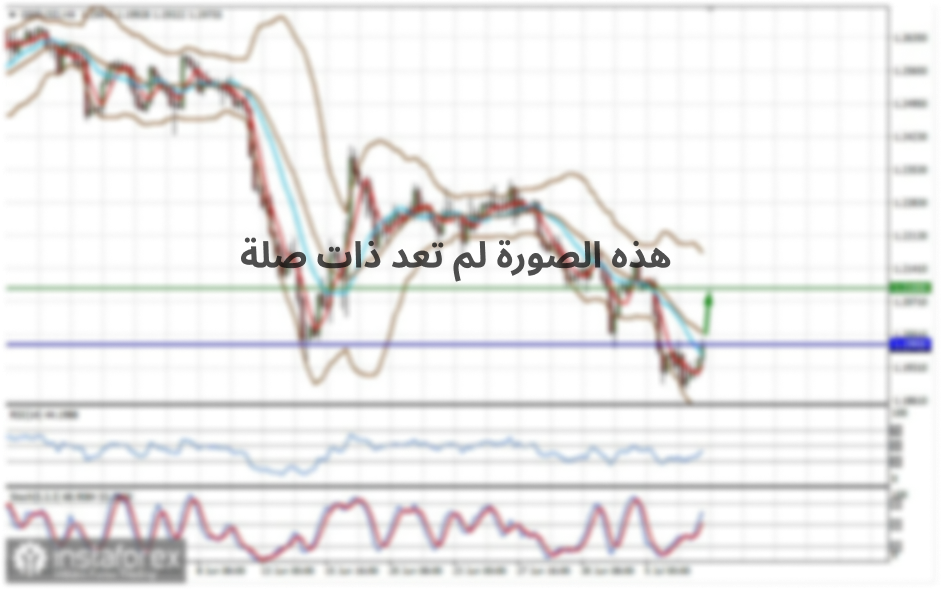

EUR / USD

On May 13, the EUR / USD pair lost about 40 basis points. Thus, the construction of the alleged wave 3 in C in B continues to drag out. The current wave marking is so far unambiguous and involves the construction of a rising wave. But in case of a successful attempt to break through the minimum of wave B, it will require corrections and additions. Roughly the same thing happens if the tool will update the low waves 2 to C in B.

Fundamental component:

The entire background of the information was reduced to a speech by the Fed Chairman Jerome Powell saying that the country is in a very difficult recession and that everything will depend on how the fight against coronavirus proceeds. Powell indicated that the US Congress should provide great financial support to the US economy, as additional to the 3 trillion dollars that he has already poured into it. Also reassured that the Fed does not plan to use negative interest rates. Thus, Powell's presentation can be interpreted in different ways. On the one hand, the Fed is not going to further mitigate monetary policy, on the other hand, hundreds of billions of dollars can continue to flow into the economy. One might say that the markets were not too upset because the US economy will be in a recession for a long time. Probably because the rest of the countries are also experiencing similar, and perhaps worse, problems. Thus, despite the fact that wave marking involves the construction of an upward wave, the US dollar is slowly but creeping down, strengthening in pair with the euro. Today, a report on applications for unemployment benefits will be released in the United States, which is most likely to be weak again. However, the mood of the markets is unlikely to deteriorate because of it. Everyone has become accustomed to the idea that unemployment in the United States will reach 20-25%. a report on applications for unemployment benefits will be released in the United States, which is most likely to be weak again. However, the mood of the markets is unlikely to deteriorate because of it. Everyone has become accustomed to the idea that unemployment in the United States will reach 20-25%. a report on applications for unemployment benefits will be released in the United States, which is most likely to be weak again. However, the mood of the markets is unlikely to deteriorate because of it. Everyone has become accustomed to the idea that unemployment in the United States will reach 20-25%.

General conclusions and recommendations:

The Euro-Dollar pair presumably continues to build the upward wave C in B. Thus, I recommend buying the instrument with targets located, as before, around 1.1148, which equates to Fibonacci 0.0%, or near the peak of wave A on a new MACD signal "up". A successful attempt to break through the minimum of wave B will require corrections and additions to the current wave marking.

GBP / USD

On May 13, the GBP / USD pair lost a few dozen basis points and thus resumed the construction of a prospective wave within 2 or B. A successful attempt to break through the 38.2% Fibonacci level will lead to even more complication of this wave. At the same time, the whole wave 2 or B can take a more elongated 5-wave horizontal form. An unsuccessful attempt to break the 1.2170 mark will indicate that the markets are not ready for further sales of the pound.

Fundamental component:

The news background for the GBP / USD pair on May 13 was quite interesting. An important data came out on the UK's GDP for the first quarter, which sparked a bit of optimism in the buyers of the pound. According to March results, the GDP fell not as much as the markets expected. Industrial production also turned out to be better than expected. However, in the case of the pound sterling, the US currency continues to be in higher demand, threatening to complicate the entire wave marking.

General conclusions and recommendations:

The Pound-Dollar instrument is nearing completion of the construction of the second wave of a new upward trend section. Thus, now I recommend buying the pound with targets around 26 of the figure, counting on building a wave of 3 or C or d in 2 or B on a new MACD signal "up" or in case of an unsuccessful attempt to break 1.2170. A successful attempt to break the 1.2645 mark will allow you to buy the pound more confidently.