Sales remain the main trade idea

Well, as expected, the main Forex currency pair continued its downward movement during yesterday's trading. Some days earlier, US monetary officials, as well as their European counterparts, commented on the situation with inflationary growth. On the US side, the US Treasury Secretary and former Federal Reserve (Fed) chair Janet Yellen made some statements about rising inflation during an interview on CNBC. She believes that such a sharp rise in inflation is a cause for concern for the country's financial authorities as well as for ordinary US citizens. According to Yellen, this inflationary spike is the negative impact of the COVID-19 epidemic on the US economy.

First of all, supply disruptions, which the White House administration is trying to regulate, are causing rampant inflationary growth. In addition to the administration of US President Joe Biden, the Fed has also an important role to play. Moreover, current Fed chairman Jerome Powell and his eventual successor Brainard must win broader support in the US Senate. However, Janet Yellen expects inflation to start easing in the second half of next year. Prices will fall as pre-pandemic living standards recover. As for the debt ceiling, US Treasury Secretary Yellen believes that it must be raised, otherwise, a recession in the world's leading economy cannot be ruled out.

The Dutch central bank president and a member of the Governing Council of the European Central Bank (ECB) also made a speech on inflation. Knot believes that inflation will fall closer to the end of next year. In his opinion, a surge in inflation that is higher than previously forecast by the ECB should not be a reason to change interest rates in the eurozone. However, the statements of Janet Yellen and her European counterpart do not differ much. It is obvious from the comments of these officials that the normalization of inflation in the USA should occur a little earlier. This makes sense given the Fed's earlier and more aggressive measures to support the economy during COVID-19.

The main macroeconomic events of the day today will be the release of business activity indices for the manufacturing and services sectors. More details on release times and forecasts for these and other releases can be seen in the economic calendar.

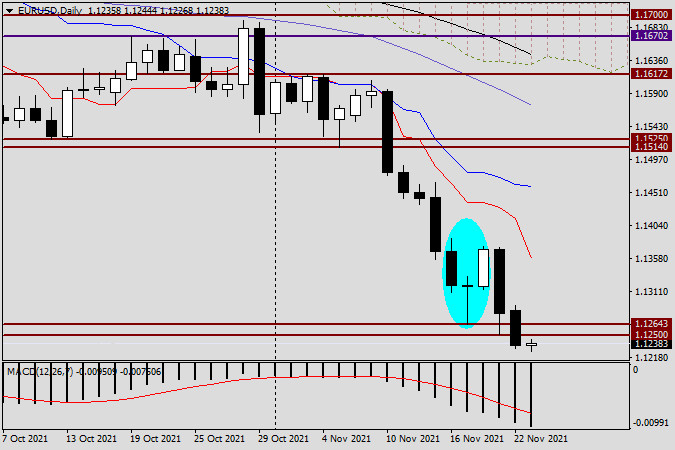

Daily

Expectations that the euro/dollar is likely to continue to decline were fully justified during yesterday's trading. The pair broke the support levels of 1.1264 and 1.1250, ending the session on November 22 at 1.1235. There was a pullback to the broken levels and probably an attempt by the Eurobulls to take the pair back above 1.1264. If they manage to do so, we will have to state a false break of both levels. Well, in case of reversal candlestick patterns appear around 1.1250-1.1264 on this time frame or on the smaller time frames, there will be a signal to open sell trades, which still seems to be the main trading idea.

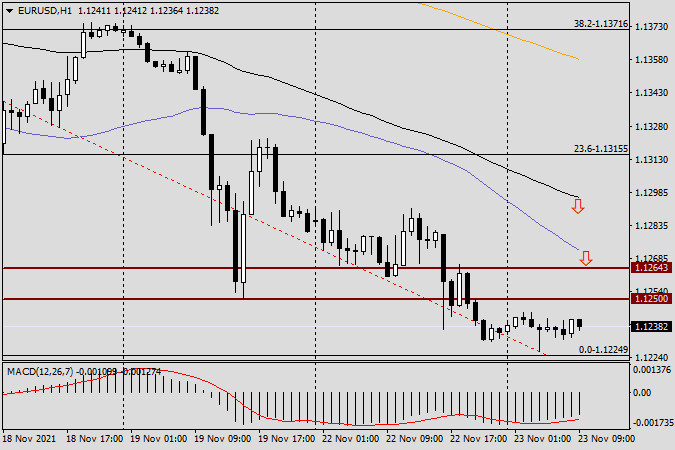

H1

On the hourly chart of the EUR/USD, above the broken 1.1250 level yesterday, there is a 50 simple moving average, which is able to act as a strong resistance and turn the rate southward again. With the black 89 EMA just under the important level of 1.1300, a pullback to this key level cannot be completely ruled out. Thus, the area for potential selling is suggested to widen and wait for confirmation candlestick signals for a decline in the price range of 1.1250-1.1300. In my personal opinion, this is currently the best trading recommendation. For those who want to buy, I suggest being patient and waiting for appropriate signals to open long positions. Buying is undoubtedly riskier, as it is against a gaining bearish trend.