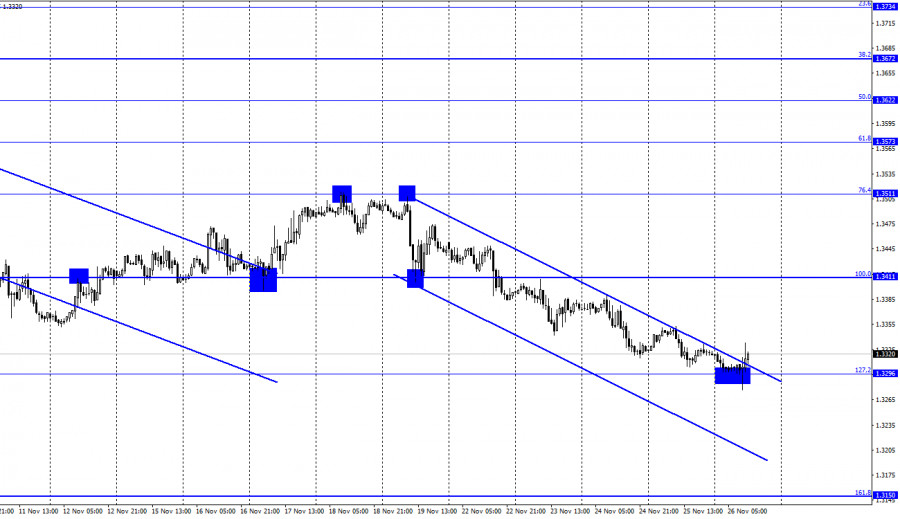

GBP/USD – 1H.

On the hourly chart, GBP/USD fell to the corrective level of 127.2% or 1.3296. A rebound from this level would suggest a reversal in favor of the British currency and some gains towards 1.3411, the Fibonacci level of 100.0%. The closing of quotations above the downtrend corridor increases the probability of a rise in the British currency. However, at the moment the growth of this currency is very weak. The information background was absent yesterday and is absent today. The speech of Governor Andrew Bailey of the Bank of England did not provide any important information to traders. There was no information backdrop yesterday and there is no important news today. In the UK, on the other hand, the confrontation with the European Union continues. Negotiations are currently ongoing between London and Brussels on a protocol on Northern Ireland.

According to Maros Sefcovic, vice-president of the European Commission, negotiations will probably continue into next year. "Looking at how far we progressed over the last four weeks, the level of detail our U.K. partners want to discuss, I know that we will probably not be able to resolve everything before the end of the year," he said. There was also another conflict just a few weeks ago. France accused Britain of refusing to issue licenses to French fishermen. This dispute was quickly resolved, but yesterday there was new information that French fishermen intend to blockade the Channel Tunnel as well as three French ports in order to draw the attention of the French government to their problem and to protest against the actions of the British government. According to the French government, around 15 French vessels remain without a license, although the UK had previously said it had refused licenses to only "a few vessels" because of documentation issues. The dispute could thus flare up again in the coming days and weeks.

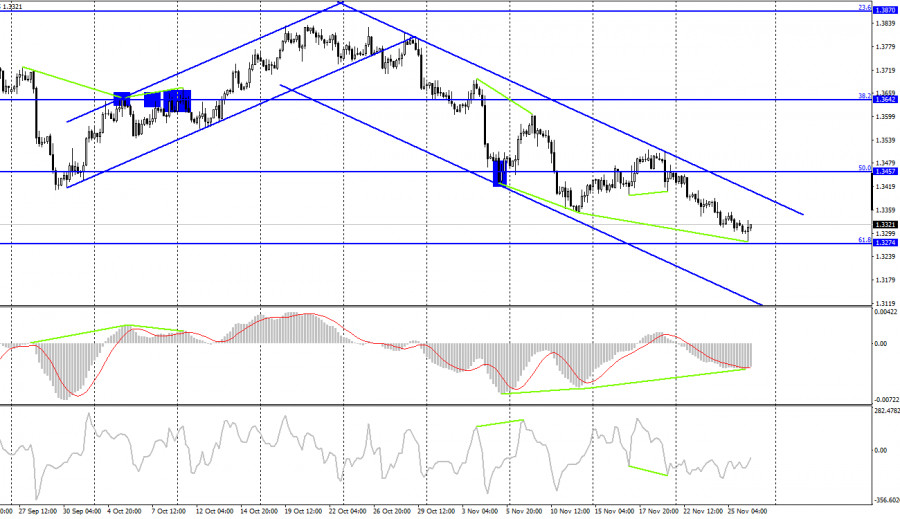

GBP/USD – 4H.

On the 4-hour chart, the GBP continues to fall towards 1.3274, the next Fibonacci level of 61.8%. However, a bullish divergence in the MACD indicator allowed a reversal in favour of the British currency. It also allows expecting some growth towards the correction level of 50.0% or 1.3457. The pair's consolidation under the Fibonacci level of 61.8% will be in favour of the US currency and the continuation of the drop in the direction of the correctional level of 76.4% or 1.3044. It will also cancel the bullish divergence.

Economic calendar for US and UK

On Thursday there were no important economic events in the USA and the UK. Thus, there will be no information background today. Traders can lock in parts of the selling profits.

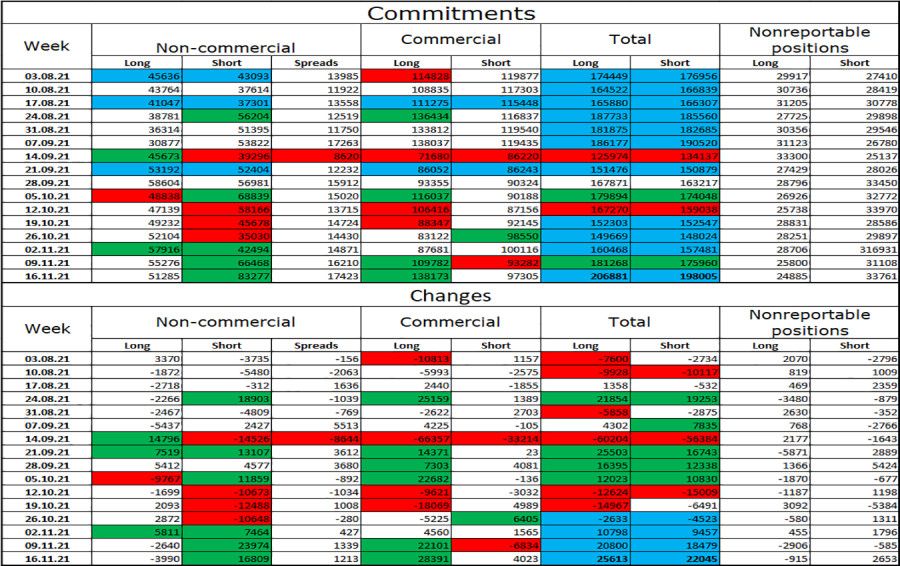

COT(Commitments of traders):

The recent COT report on GBP/USD from November 16 shows that large market players are turning more bearish. On the reported week, speculators closed 3,990 long contracts and opened 16,809 short contracts. Notably, the number of short contracts has been strongly increasing for the second week in a row. All in all, speculators opened almost 40,000 short contracts for two weeks. In other words, half of the newly opened contracts are short ones. A week ago, the number of long contracts was 17,000 more. Nevertheless, speculators are hesitant to express clear market sentiment. They increase buy positions and then suddenly increase sell contracts, but the total number of long and short contracts for all categories of traders remain roughly the same: 206K – 198K. Hence, after a few weeks of active selling GBP/USD, speculators may rush opening long positions.

Outlook for GBP/USD and trading tips

I recommended selling the GBP if the pair closes below 1.3411 with the target at 1.3296. This target has been met. I recommended buying the pound if it rebounds from 1.3296 on the hourly chart with a target of 1.3411. These deals should now be kept open.

Terms

The Non-commercial category includes major market players: banks, hedge funds, investment funds, private, and large investors.

The Commercial category embraces commercial enterprises, firms, banks, corporations, companies that buy currency not to obtain speculative profit, but to ensure current activities or export-import operations.

The category of Non-reportable positions means retail traders who do not have a significant impact on the price.