To open long positions on GBP/USD, you need:

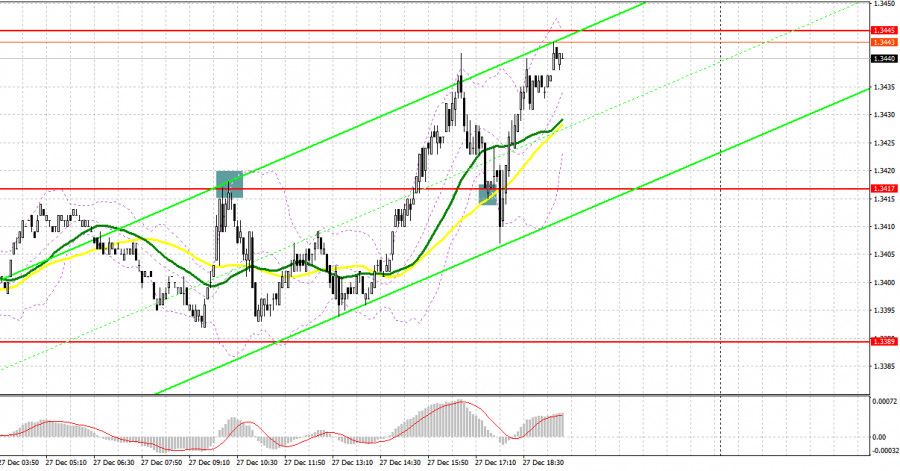

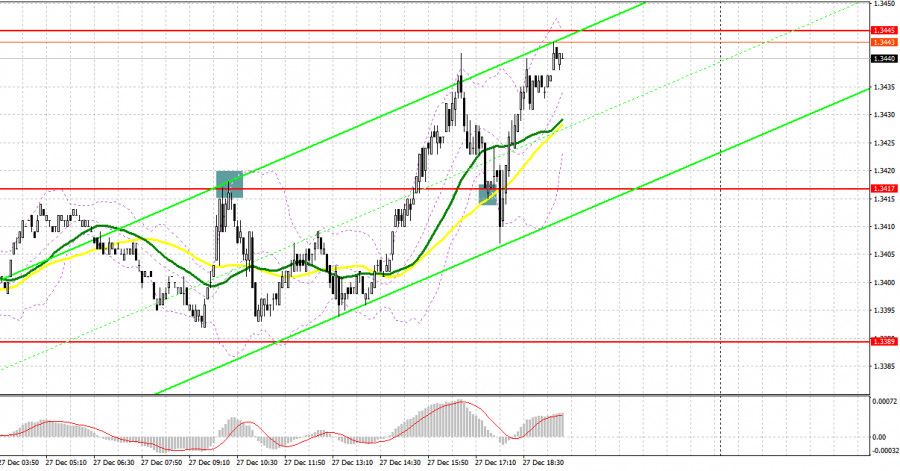

Several excellent signals to buy the British pound were formed yesterday. Let's take a look at the 5 minute chart and understand the entry points. In my morning forecast, I paid attention to the 1.3417 level and advised you to make decisions on entering the market. Failure to surpass this range resulted in creating an excellent signal to open short positions. As a result, the pound sank 20 points to the support area of 1.3389, the test of which was not enough. Bulls were more active and reached the breakdown of 1.3417 in the afternoon. A reverse test of this level from top to bottom led to forming a signal to buy GBP/USD, which I described in detail here in this review. As a result, the growth amounted to about 30 points.

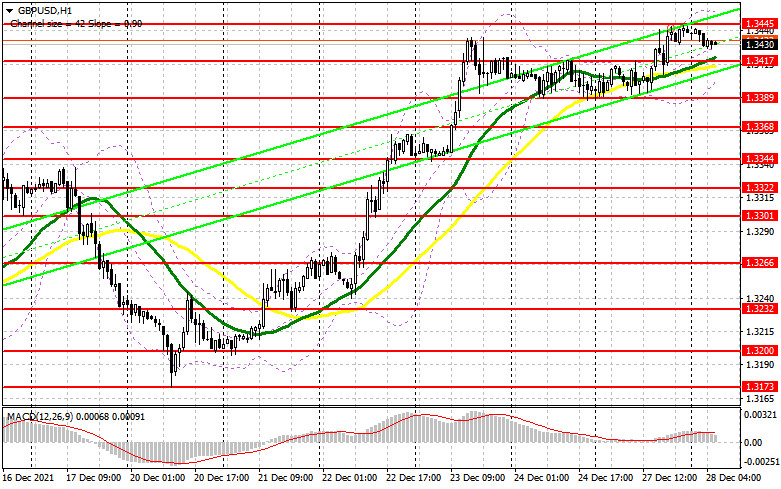

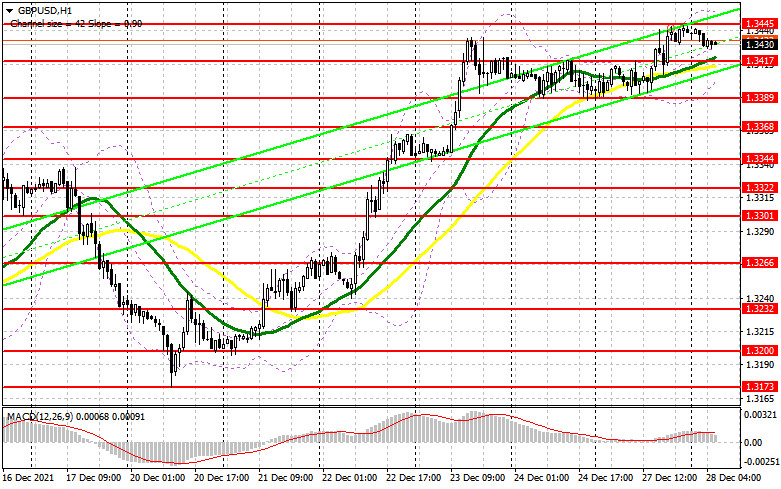

The absence of important fundamental statistics on the UK should affect the volatility of the market in the first half of the day. Larger movements are only expected during the US session, when a number of reports on the US economy are released. Given how high the pound has climbed, the bulls' top priority for today is to protect the new support at 1.3417. This level is very important, as a breakdown could force traders to take profits from the December highs at the end of the year, which will lead to creating pressure on the pound. Forming a false breakout at 1.3417 generates a signal to buy GBP/USD with the prospect of a continuation of the bull market aimed at breaking through the resistance at 1.3445, which we stumbled over yesterday. A breakdown and test of this level from top to bottom will provide an additional entry point and strengthen the bulls' positions in order to continue building a bullish trend and renew highs: 1.3472 and 1.3506. The 1.3560 level is a more distant target, which is where I recommend taking profits. In case the pound falls during the European session and lack of activity at 1.3417, it is best to postpone buying to the level of 1.3389 - there is a big bull in this area. Forming a false breakout there will provide an entry point, counting on the preservation of the bullish momentum. You can buy GBP/USD immediately on a rebound from 1.3368, or even lower - from a 1.3344 low, counting on a correction of 20-25 points within the day.

To open short positions on GBP/USD, you need:

The bears missed their chance yesterday and failed to keep the resistance at 1.3417 under their control. Now we need to think about something around 1.3445. Protecting this range will be of paramount concern. Forming a false breakout at this level creates the first entry point into short positions with a subsequent decline to the 1.3417 area, which will have to be fought for, since the bulls clearly do not intend to release the upward trend at the end of the year in anticipation of a more aggressive monetary policy from the Bank of England in the spring. A breakdown of 1.3417 and a reverse test from the bottom up will increase pressure on the pound and bring it down to the next support at 1.3389, where, as I noted above, there is a big bull looking for new patterns. Only the consolidation and the reverse test of 1.3389 from the bottom up will provide a new entry point into short positions with the prospect of a decline in GBP/USD to 1.3368 and 1.3344, where I recommend taking profits. In case the pair grows during the European session and the bears' are weak at 1.3445, it is best to postpone selling until the larger resistance at 1.3472. I also recommend opening short positions there in case of a false breakout. Selling GBP/USD immediately on a rebound is possible from a large resistance at 1.3506, or even higher - from a new high in the 1.3560 area, counting on the pair's rebound down by 20-25 points within the day.

I recommend for review:

The Commitment of Traders (COT) report for December 14 revealed that both short and long positions decreased. Considering that long positions nearly halved, this led to major changes in the negative delta. At the same time, it should be noted that this data does not include the outcome of the meetings of the US Federal Reserve and the Bank of England. As a whole, the outlook for the British pound is rather gloomy. Following the Bank of England's decision to raise interest rates, the pair rallied. However, the very next day, it faced a sell-off. As a result, many market participants hoping for the end of the bearish trend were out of the market. The US dollar will most likely enjoy high demand amid uncertainty over the new Omicron coronavirus strain, which is spreading at a fairly rapid pace, scaring off market participants from active actions. No one wants to buy an overbought dollar. At the same time, a weak pound is not attractive to investors. Until the situation with the new coronavirus wave returns to normal, the British pound will hardly gain strong upside momentum. However, high inflation remains the main reason why the Bank of England will continue to raise interest rates next year. This fact is likely to support the pound sterling. The COT report released on December 14 indicated that long non-commercial positions declined to 29,497 from 48,950, while short non-commercial positions dropped to 80,245 from 87,227. This resulted in an increase in the negative non-commercial net position from 38,277 to -50 748. The weekly closing price dipped to 1.3213 from 1.3262.

Indicator signals:

Trading is carried out above 30 and 50 moving averages, which indicates the continued growth of the pound in the short term.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakthrough of the upper border of the indicator in the area of 1.3445 will lead to a new wave of growth in the pair. A breakout of the lower border of the indicator in the area of 1.3389 will lead to a larger sell-off of the pound.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.