Analysis of trades and trading recommendations for GBP/USD

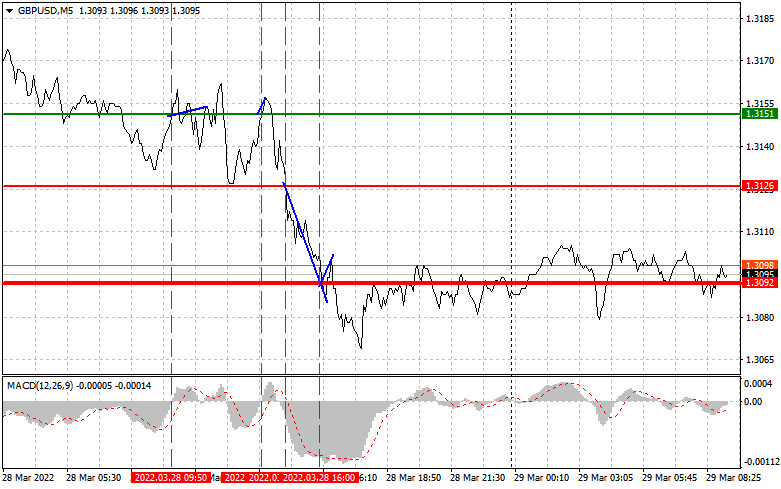

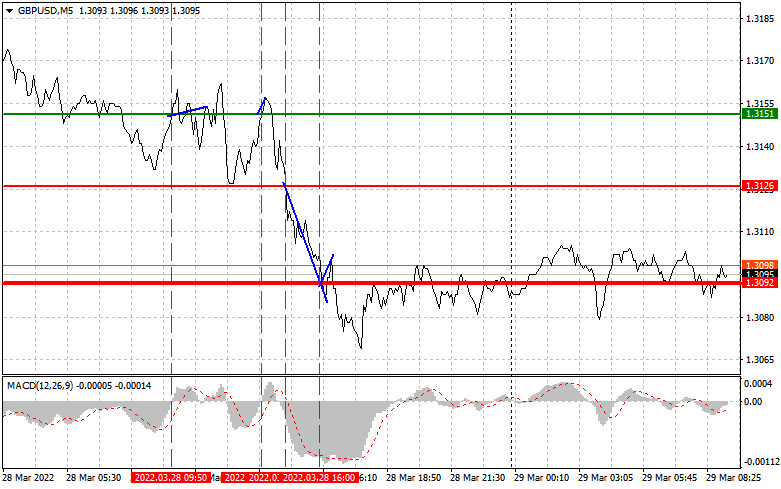

There were lots of entry points for the pound sterling yesterday. However, speculators were able to make a profit only in the afternoon. After Andrew Bailey's speech, the pound sterling declined sharply. The price tested the 1.3151 level in the first half of the day. At that time, the MACD indicator was just starting to move up from the zero level. It was confirmation of the correct entry point to long positions according to scenario No. 1. I mentioned that level in yesterday's morning article. Unfortunately, there was no major upward movement. After several unsuccessful attempts to break through to the weekly high, the pair dropped. A similar situation with long positions occurred in the middle of the European session. In that case, traders also closed unprofitable positions. However, they were able to sell the pound sterling and recoup losses only after the breakout of 1.3126. At the time, the MACD indicator began to move down from the zero level. As a result, the downward movement was about 30 pips. Long positions on the rebound from 1.3092 did not bring the expected profit.

Yesterday, BoE governor Andrew Bailey delivered a speech. He commented on the turmoil in commodity markets that increase inflation pressure. The pound sterling nosedived after the BoE governor said that the regulator would take a wait-and-see approach to monetary policy due to market uncertainty. At the same time, the US dollar jumped in the afternoon after the release of US trade balance and wholesale inventories data. The pound/dollar pair fell down even more. Today, market participants are anticipating the talks between Russia and Ukraine. The macroeconomic calendar includes the UK M4 report and mortgage approvals data. However, these reports will hardly affect the pound sterling, as well as the Bank of England's quarterly bulletin. An upward movement of the pound sterling depends on the further development of the geopolitical conflict. In the afternoon, pay attention to an important report on the US consumer confidence report for March this year. The figure is likely to be much worse than economists' forecasts, which will put pressure on the US dollar. It may also lose steam against risky assets, including the pound sterling. The speech of FOMC member John Williams may help the US dollar regain ground. Investors are likely to pay zero attention to the US Housing Index data.

Buy signal

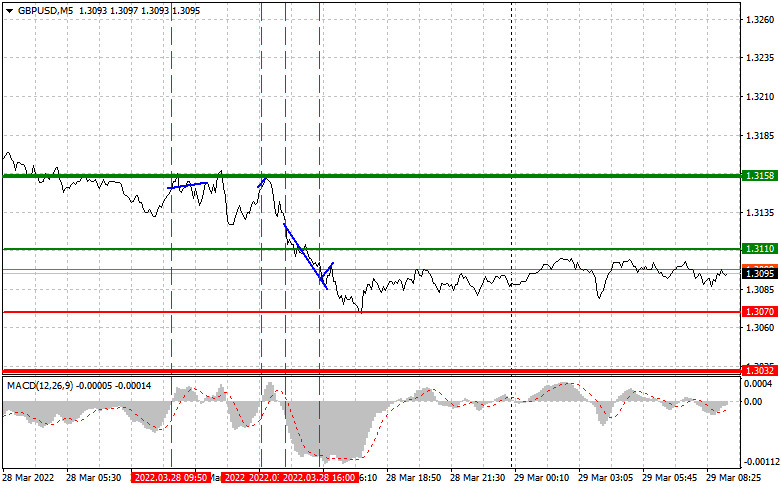

Scenario No 1: it is recommended to buy the pound sterling today if the price reaches the entry point around 1.3110 (green line on the chart) with an upward target of 1.3158 (thicker green line on the chart). I recommend closing long positions at 1.3158 and opening short ones, keeping in mind a 20-25 pip correction in the opposite direction from the given level. The British currency is unlikely to appreciate in the first half of the day, especially amid strong bearish pressure. Important! Before opening long positions, make sure that the MACD indicator is above the zero mark and it has just started to rise from it.

Scenario No. 2: it is also possible to buy the pound sterling today if the price approaches 1.3070. At that moment the MACD indicator should be in the oversold area, which will limit the downward potential of the pair. It may also trigger an upward reversal. The pair is expected to grow to the opposite levels of 1.3110 and 1.3158.

Sell signal

Scenario No.1: it is recommended to open short positions on the pound sterling if the price hits the level of 1.3070 (the red line on the chart). If so, it will lead to a rapid decline of the pair. The key target level is 1.3032. I would advise closing short positions at this level and opening long ones in the opposite direction, keeping in mind a 20-25 pip correction from the given level. It is better to focus on short positions as the economic prospects of the UK are becoming gloomier every day. Important! Before opening short positions, make sure that the MACD indicator is below the zero level and it has just started to decline from it.

Scenario No. 2: it is also possible to sell the pound sterling today if the price reaches 1.3110. At this moment, the MACD indicator should be in the overbought area, which will limit the upward potential of the pair. It may also trigger a downward reversal. The pair is excepted to drop to the opposite levels of 1.3070 and 1.3032.

Description of the chart:

The thin green line shows the entry point for long positions

The thick green line is the estimated price where you can place a Take profit order or do it manually as the price is unlikely to rise above this level.

The thin red line shows the entry point for short positions

The thick red line is the estimated price where you can place a Take profit order or do it manually as the price is unlikely to decline below this level.

The MACD indicator. When entering the market, it is important to pay attention to overbought and oversold zones.

Important. Novice traders need to make very careful decisions when entering the market. It is better to stay out of the market before the release of crucial reports. You may avoid losses due to sharp fluctuations in the exchange rate. If you decide to trade during the news release, then always place stop orders to minimize losses. Without placing stop orders, you can lose the entire deposit very quickly, especially if you do not use money management but trade in large volumes.

Remember that it is necessary to have a trading plan for successful trading, following the example I presented above. Relying on spontaneous trading decisions based on the current market situation is a losing strategy of an intraday trader.