Analysis of trades and tips for trading GBP

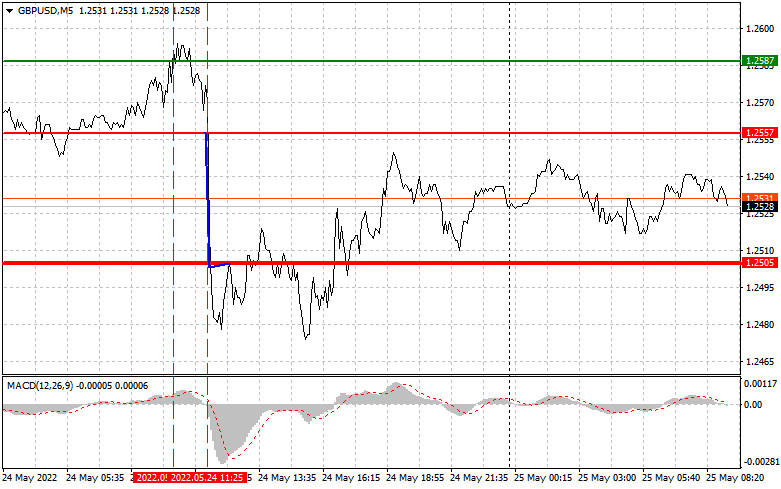

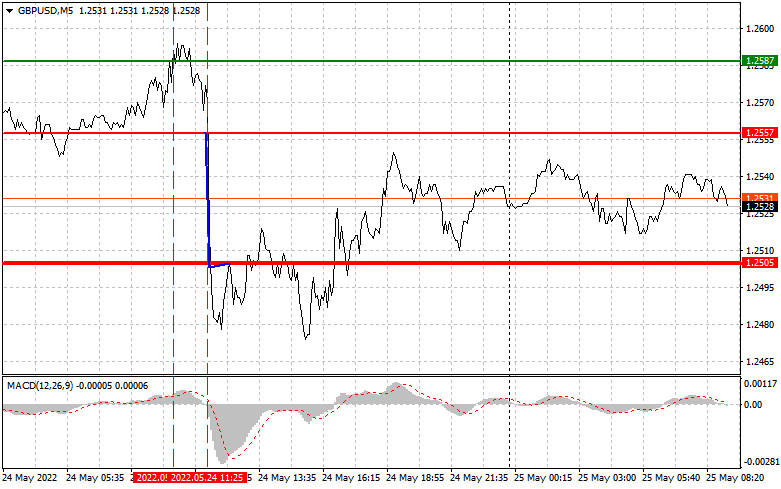

The test of 1.2587 in the morning occurred came at a time when the MACD indicator moved far enough from the zero level. Therefore, the pound sterling could hardly perform another sharp upward reversal. For this reason, I refrained from opening new long potions. Short positions according to scenario No.2 were also off the table. After the publication of weak UK macro stats, the pound sterling slid down. The test of 1.2557 took place at a time when the MACD indicator had just started to move down from the zero level. It was an excellent sell signal which brought more than 50 pips of profit. The pound/dollar pair declined to the support area of 1.2505. Long positions for a bounce from this level did not bring any profit. So, traders closed their positions with zero results.

As expected, disappointing data on PMI indices fueled a downward movement, erasing gains of the previous day. The scenario for short positions turned out to be accurate. PMI indexes data for the US did not boost the US dollar. So, the pair did not roll back sharply one more time. The economic calendar for the UK is again empty today. It has been of little help to the pound sterling recently as it provides no drivers for its growth. To this end, it is better to stick to the implementation of scenario No. 1 on purchases. In my opinion, the pair may undertake an attempt to rebound to weekly highs. If bulls show no energy in the first half of the day, it is recommended to pay attention to scenario No. 1 for short positions closer to the American session. In the afternoon, the report on durable goods orders is due. Analysts anticipate a positive figure. In addition, Fed member Lyelle Brainard will deliver a speech. However, traders are waiting with bated breath for the publication of the FOMC meeting minutes for May. They will look for hints of more aggressive monetary policy tightening by the Fed this summer. If the content of the minutes is not hawkish, the pressure on the US dollar will remain. Thus, there could be a rise in risk appetite.

Buy signal

Scenario No.1: it is recommended to buy the pound sterling today if the price reaches 1.2545 (green line on the chart) with an upward target of 1.2590 (thicker green line on the chart). I would advise closing long positions at 1.2590 and opening short ones, keeping in mind a downward correction of 30-35 pips from the given level. The pound sterling is likely to grow today in the first half of the day as the economic calendar is empty. Important! Before opening long positions, make sure that the MACD indicator is above the zero mark and it has just started to rise from it.

Scenario No.2: it is also possible to buy the pound sterling today if the price approaches 1.2518. At this moment, the MACD indicator should be in the oversold area. It may limit the downward movement. It could also trigger an upward reversal. The pair is expected to touch the opposite levels of 1.2545 and 1.2590.

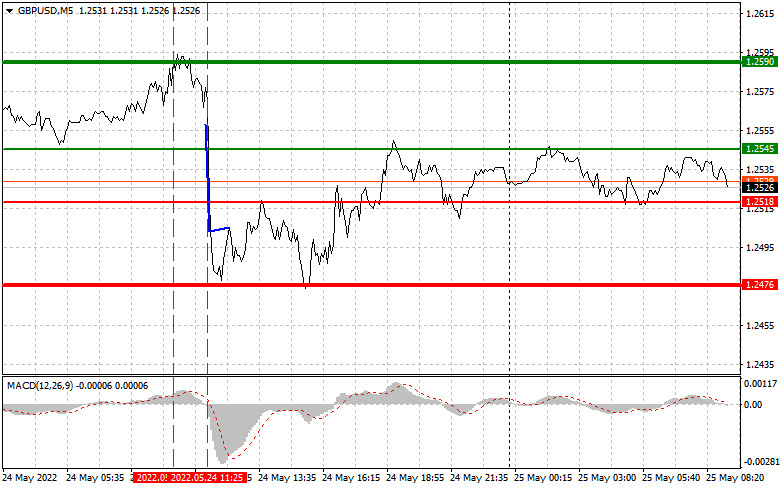

Sell signal

Scenario No.1: it is recommended to open short positions on the pound sterling today only if the price hits 1.2518 (the red line on the chart). If so, the pair may drop sharply. The main task of sellers is to push the pair to 1.2476. I would advise closing short positions at this level and opening long ones, keeping in mind an upward correction of 20-25 pips from the given level. The pressure on the pound sterling may return if bears show no activity in the first half of the day. Important! Before opening short positions, make sure that the MACD indicator is below the zero mark and it has just started to decline from it.

Scenario No.2: it is also possible to sell the pound sterling today if the price tumbles to 1.2545. At this moment, the MACD indicator should be in the overbought area. It could limit the upward movement of the pair. It may also trigger a downward reversal. The pair is expected to take a nosedive to the opposite levels of 1.2518 and 1.2476.

What's on the chart:

The thin green line is the entry price to buy the trading instrument.

The thick green line is the estimated price where you can place a Take Profit or lock in profit manually as the price is unlikely torise above this level.

The thin red line is the entry price to sell the trading instrument.

The thick red line is the estimated price where you can place a Take Profit or lock in profit manually as the price is unlikely todecline below this level.

The MACD indicator is important for checking the overbought and oversold zones.

Important: beginners on Forex need to be very careful when making their entry decisions. It is better to stay out of the market ahead of important news releases in order to avoid sharp price fluctuations. If you decide to trade at the moment of publication, then always place stop-loss orders to minimize losses. Without a Stop Loss, you can easily lose your entire deposit, especially if you do not follow money management and trade in large volumes.

For successful trading, you need to have a clear trading plan, like the one presented above. Spontaneous decision-making based on the current market situation is a losing strategy for an intraday trader.