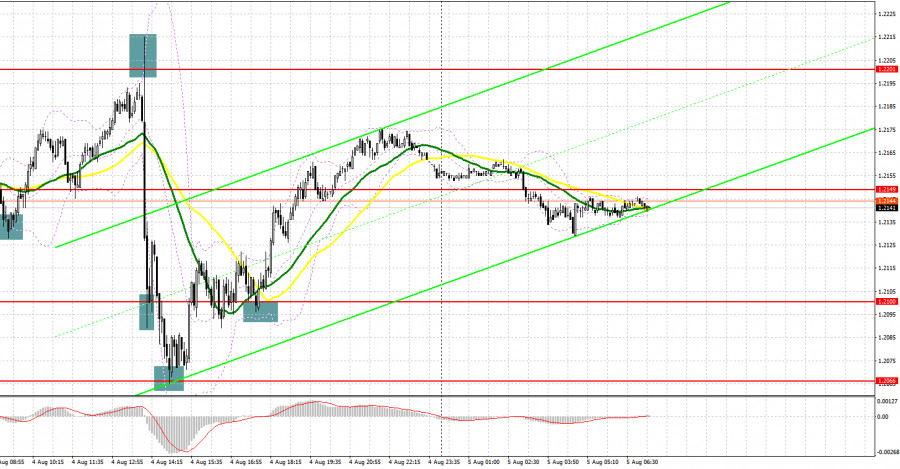

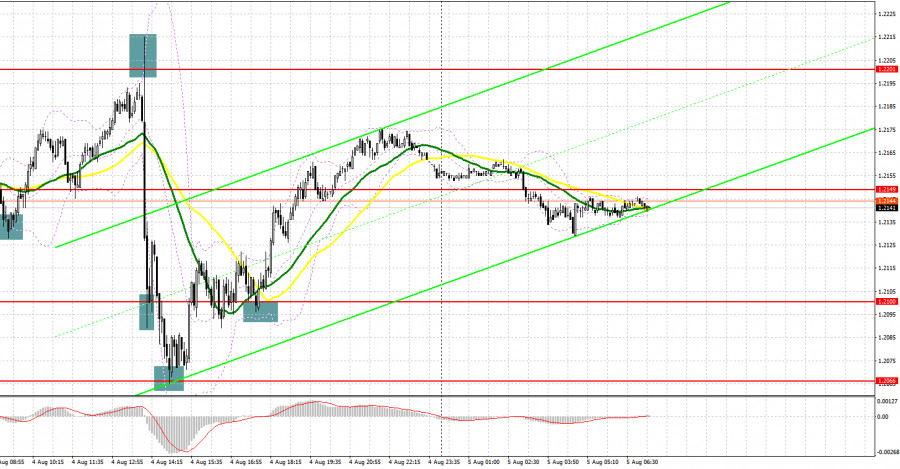

Several excellent market entry signals were formed yesterday. Let's take a look at the 5-minute chart and see what happened. I paid attention to the 1.2137 level in my morning forecast and advised making decisions from it. The pound slightly corrected down at the beginning of European deals, but bulls did not allow it to break through below 1.2137, which led to a great buy signal. As a result, the pair rose by more than 40 points on the first move. The second move could capture about 50 points. Immediately after the Bank of England's decision to raise interest rates, the pound tried to get above 1.2201, but a false breakout at this level gave a sell signal, which led to a major fall to the 1.2100 area. The bulls tried to protect this range from the first test and even created an entry point into long positions there, but this was not enough. From the second time, the bears failed to hit 1.2100 and reached the test of 1.2066. A false breakout and a great buy signal there led the GBP/USD to move up by more than 90 points by the end of the day.

When to go long on GBP/USD:

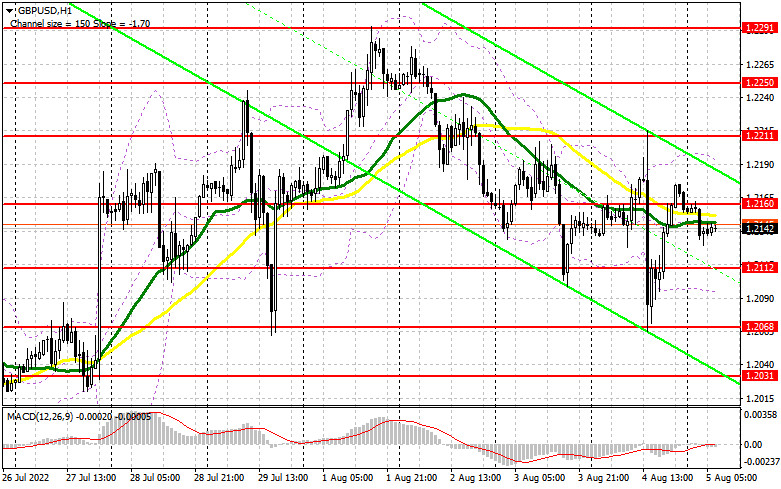

The BoE raised interest rates by 50 basis points on Thursday, the biggest single increase since 1995. The sixth consecutive hike raises the cost of borrowing to 1.75% and marks the first half-point increase since the central bank became independent from the British government in 1997. The Monetary Policy Committee voted by an 8-to-1 majority in favor of a historic half-point hike and cited rising inflationary pressures in the UK. As for today, it is unlikely that anything will help the pound to continue to rise, as only data on the house price index from HBOS in the UK are expected, as well as a speech by BoE MPC member Huw Pill. It is unlikely that he will say something new that BoE Governor Andrew Bailey did not say yesterday. If the pair falls even before the release of the US labor market data in the first half of the day, the best scenario for buying will be a false breakout in the area of the nearest support of 1.2112. In this case, you can count on a new GBP/USD spurt up to 1.2160, where the moving averages are passing, playing on the bears' side. A breakdown of this level opens the way to a high of 1.2211. A more distant target will be the area of 1.2250, where I recommend taking profits. You can count on updating monthly highs only in case of very weak statistics on the US labor market.

If the GBP/USD falls and there are no bulls at 1.2112, the pressure on the pound will increase again, which will force the bulls to take profits. If this happens, I recommend postponing long positions to 1.2068, a major support formed as early as July 29th. I advise you to buy there only on a false breakout. You can open long positions on GBP/USD immediately for a rebound from 1.2031, or even lower - in the area of 1.2001, counting on correcting 30-35 points within the day.

When to go short on GBP/USD:

Yesterday, the bears did everything possible to bring the pound as low as possible after the BoE's decision and negative forecasts for inflation and economic growth, however, the bulls took advantage of this moment and quickly bought a new bottom, still counting on the continuation of the upward trend after the downward correction observed this week . The optimal scenario for opening short positions today would be a false breakout in the area of 1.2160, growth to which may occur after the UK data. This will bring back pressure on the pound with the goal of moving to the nearest support at 1.2112, formed on the basis of yesterday. A breakthrough and reverse test from the bottom up of this range will provide an entry point for selling with a fall to 1.2068, and a further target will be the area of 1.2031, where I recommend taking profits.

In case GBP/USD grows and there are no bears at 1.2160, bulls will have an excellent chance of a return to 1.2211. Only a false breakout around 1.2211 will provide an entry point to short positions, counting on the correction of the pair to the downside. If traders are not active there as well, a surge up to the high of 1.2250 may occur. There, I advise you to sell GBP/USD immediately for a rebound, based on a rebound of the pair down by 30-35 points within the day.

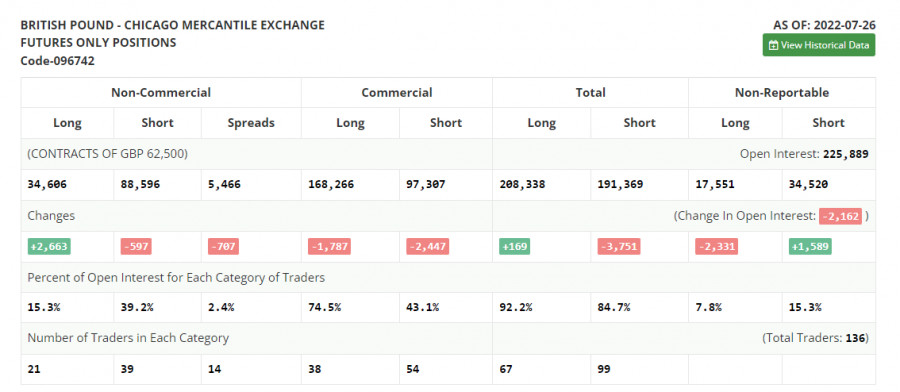

COT report:

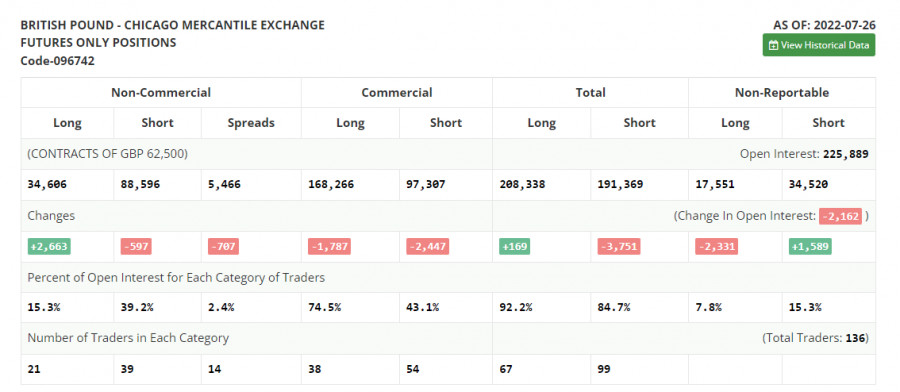

According to the Commitment of Traders (COT) report from July 26, the number of short positions dropped, whereas the number of long positions surged, reflecting the current market situation. The British pound is in demand. What is more, there is no doubt that the BoE will continue raising the benchmark rate this month. The central bank's aggressive policy has been having a positive influence on the national currency despite some economic problems. Last week, the US Fed decided to hike the key interest rate to combat surging inflation. This action is likely to affect the BoE's decision. Notably, demand for the pound sterling is not as high as it might seem. The pound/dollar pair is gaining in value amid the falling greenback. The fact is that there are rumors that the Fed may loosen its monetary policy this autumn. Even amid this backdrop, the pound sterling is unlikely to go on rising due to the cost of living crisis and economic slowdown. The COT report unveiled that the number of long non-commercial positions increased by 2,663 to 34,606, whereas the number of short non-commercial positions declined by 597 to 88,596. As a result, the negative value of the non-commercial net position decreased to 53,990 from -57,250. The weekly closing price rose to 1.2043 against 1.2013.

Moving averages

Trading is below the 30 and 50-day moving averages, which indicates a continuation of the downward correction.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of growth, the area of 1.2200 will act as resistance. In case the pair goes down, the lower border of the indicator around 1.2100 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.