A block of macroeconomic statistics in retail, manufacturing and the labor market were just released in the US. The latest macroeconomic reports are of a secondary nature, but still, under certain conditions - if they were in unison in the green zone - they could support the US currency. But to the disappointment of the dollar bulls, the statistical picture turned out to be quite contradictory. As a result, the EUR/USD pair is forced to continue circling around the parity level: neither the bears nor the bulls are yet able to make a powerful price breakthrough from the 1.0000 mark.

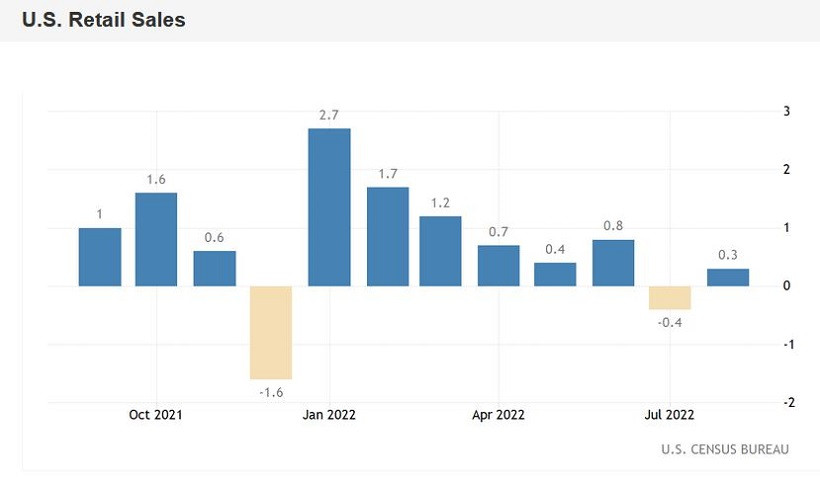

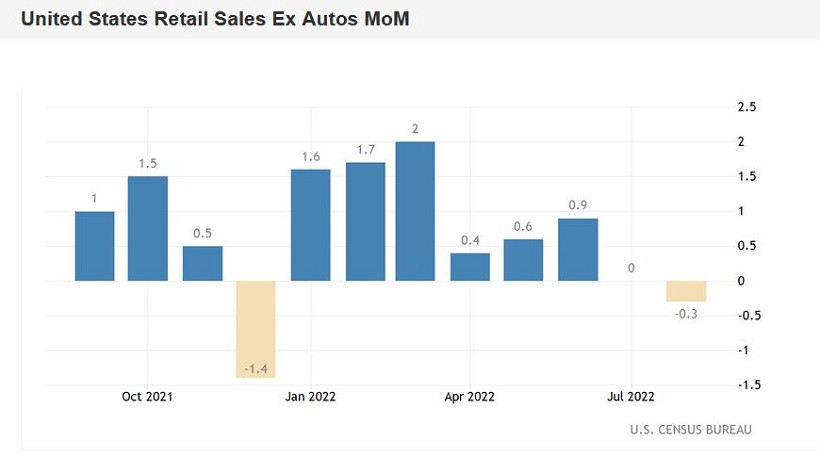

Perhaps the central macroeconomic release of Thursday is a report on the growth of retail sales in the US. The overall indicator showed a positive trend, rising to 0.3%, while most experts expected zero growth. However, the volume of retail sales, excluding motor vehicles, decreased by 0.3%.

Disappointing data on industrial production. Thus, the volume of industrial production unexpectedly decreased by 0.2% in August, while analysts predicted an increase by a similar amount. The volume of production in the manufacturing industry increased slightly (by 0.1%), after a more robust growth (by 0.6%) in July. Capacity utilization decreased by 0.2 percentage points to 80.0%.

"Accompanying" indicators also came out in the red zone. For example, the manufacturing index of the Philadelphia Fed fell immediately to the level of -9.9 points, while the growth forecast was up to 2.4 points. The manufacturing index Empire Manufacturing also turned out to be in the negative area (for the second consecutive month), having decreased by 1.5 points.

However, not all of the latest reports have disappointed dollar bulls. For example, the weekly increase in initial unemployment claims was in the green zone, at around 213,000. This is the best result since June of this year. The import price index was also on the side of the greenback. This inflationary indicator slowed down, but by a smaller amount relative to the forecast values.

In other words, the latest releases left more questions than answers. Traders of the EUR/USD pair reacted quite phlegmatically to them. And in my opinion, it is quite reasonable. First, the figures will in no way affect the position of the majority of Federal Reserve members - at least in the context of the September meeting. The probability of a 75-point rate hike next week is still at its highest. This is a basic scenario, in the implementation of which almost no one doubts. Second, Fed Chairman Jerome Powell warned about the side effects of monetary tightening back in August. But at the same time, he emphasized in a separate line that the central bank intends to go all the way in curbing inflationary growth. Therefore, the inevitable "costs" of pursuing a tight monetary policy will not stop the Fed - again, at least in the context of the September meeting.

Let me remind you that the report published this week on the growth of the consumer price index exceeded the expectations of experts. The general consumer price index in the US came out at 8.3% y/y in August (against the forecast of a slowdown to 8.1% and the previous value of 8.5%). The indicator continues to be in the area of 40-year highs. And although the indicator has retreated from the July high, the CPI is still too high (including for the Fed) level. The core consumer price index, excluding volatile food and energy prices, began to show positive dynamics again. In monthly terms, an increase of up to 0.6% was recorded, in annual terms - up to 6.3% (against the forecast of growth up to 6.1%). This indicator gradually "cooled down" from May to July, slowing down its growth. But the August result exceeded the expectations of most experts. Core inflation is more than three times the US central bank's 2% target.

All this suggests that the 75-point scenario remains in place: the Fed will implement the most expected, but at the same time hawkish decision next week. And we must not forget that the latest inflation reports were published during the "silence mode", which is valid 10 days before the meeting. The rhetoric of the accompanying statement (like that of Powell at the final press conference) can also be quite hawkish. The market has already started talking about the fact that the Fed will be forced to resort to a 100-point increase, but this scenario is unlikely (at the moment the probability is estimated at 35%). And yet, the very fact of discussing such a probability also provides background support for the greenback.

Thus, the latest reports did not allow the EUR/USD bears to develop a downward trend, but at the same time they did not "drown" the dollar. Upward corrective pullbacks can be used to open short positions, with bearish targets at 1.0000 (with a pullback to 1.0050 resistance) and 0.9970 (the lower boundary of the Kumo cloud on the four-hour chart).