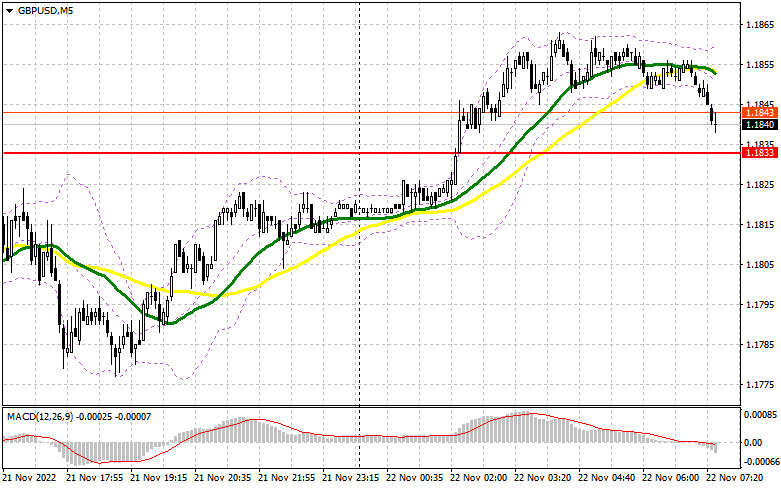

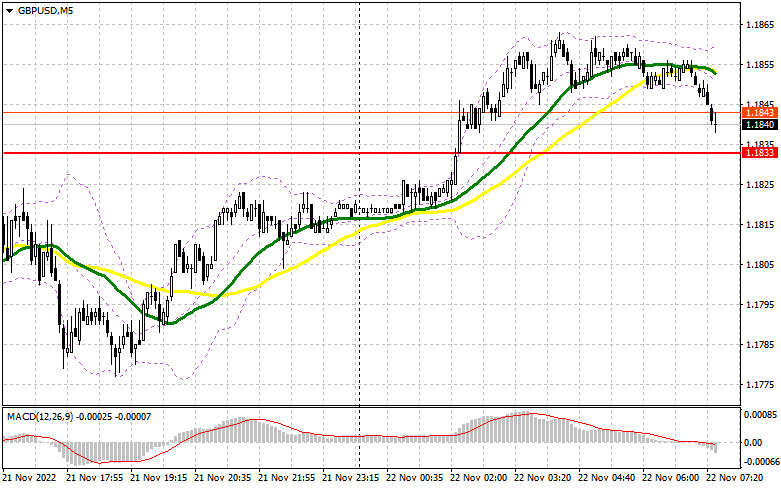

Yesterday, the pound sterling traded coolly. Let's take a look at the M5 chart to get a picture of what happened. In my previous review, I focused on several support and resistance levels. However, the pair failed to reach any of them. Due to low volatility during the European session, the pound remained stable and traded in the sideways channel following an Asian sell-off and despite the speech made by the Bank of England official. There were no entry signals generated during the North American session as the quote never reached the outlined levels.

When to go long on GBP/USD:

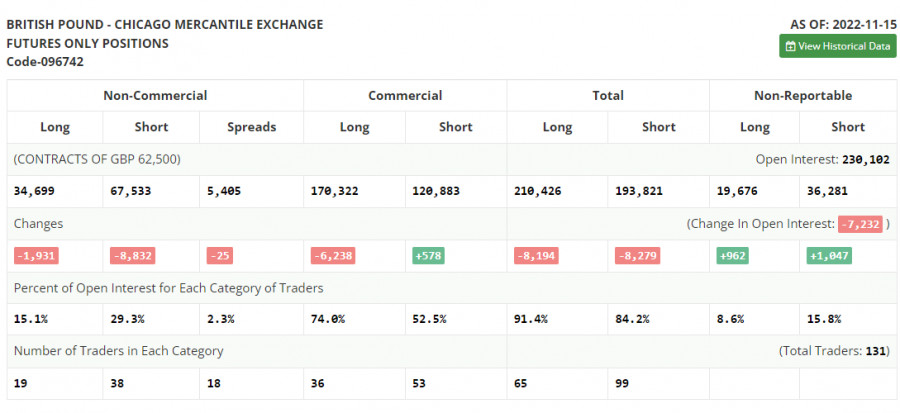

Before conducting technical analysis, let's see what takes place in the futures market. Commitments of Traders for November 15th reflect a decrease in both long and short positions. A surge in UK inflation came unexpectedly and definitely affected the BoE's interest rate plans. In light of the current situation, the regulator will have no other choice but to take an ultra-aggressive stance on monetary policy. Therefore, demand for the pound is likely to stay strong and the currency will be able to strengthen against the greenback. Still, amid all the challenges the UK economy is now facing, this will not be enough to attract major players to the market who firmly believe that the pound has entered a long-term recovery cycle. Meanwhile, the US Federal Reserve keeps fighting stubborn inflation by means of tightening as well. That is why GBP/USD is unlikely to show growth in the medium term. According to the latest COT report, long non-commercial positions dropped by 1,931 to 34,699 and short non-commercial positions decreased by 8,832 to 67,533, which led to a further increase in the negative non-commercial net position to -32,834 from -39,735 a week earlier. The weekly closing price of GBP/USD grew to 1.1885 against 1.1549.

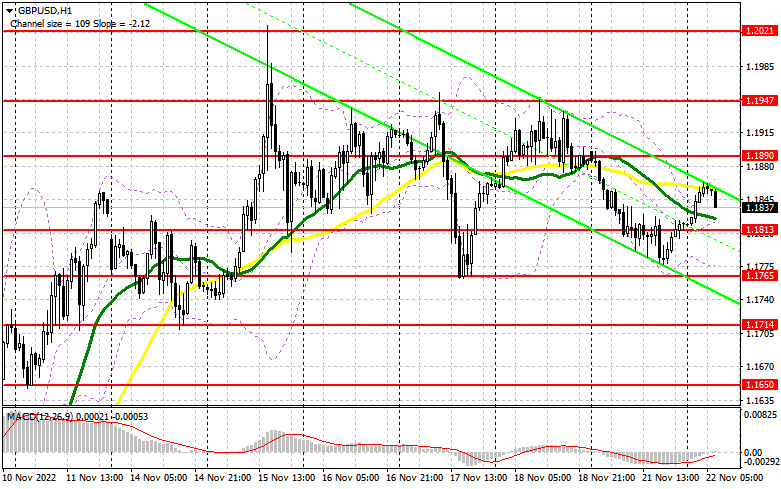

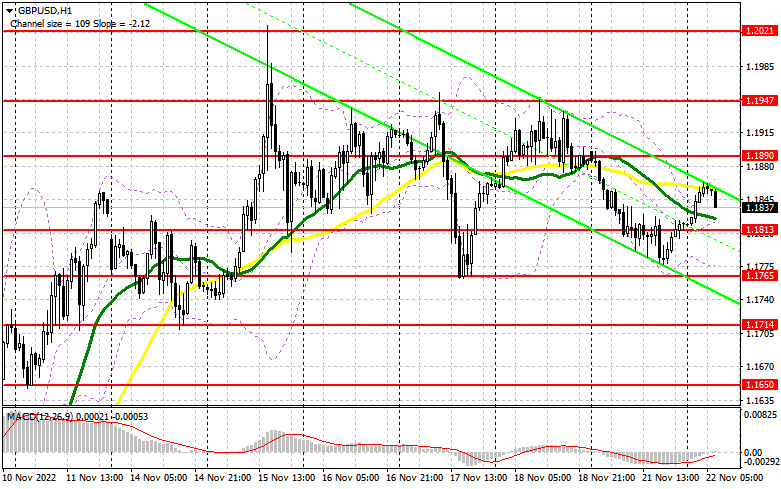

No important macro releases are scheduled for today. Still, the UK's public sector net borrowing may draw the market's attention. In this light, in order to maintain the uptrend, bulls should show their presence near 1.1813 support, which is located slightly below the bullish moving averages. A false breakout through this mark along with the release of positive macro results in the UK will give a buy signal with the target at 1.1890. This level is an important bullish target as without it the continuation of the uptrend is unlikely. Thus, after a breakout and a downside test of the mark of 1.1890, the uptrend may extend to 1.1947 where bulls may loosen their grip on the market. A more distant target is seen at 1.2021 where a profit-taking process may begin. If GBP/USD goes down and there is no bullish activity at 1.1813, the pound will come under pressure. Therefore, it would be wiser to open long positions after a false breakout through 1.1765. Long positions could also be considered at 1.1714 or 1.1650 on a bounce, allowing a correction of 30-35 pips intraday.

When to go short on GBP/USD:

A reversal is clearly impending in the market, which may trigger a mass sell-off in the pound. A sell-off may begin following the release of disappointing macro results. Since the macroeconomic calendar is empty today, the price is likely to stay within the sideways channel. If GBP/USD goes up and the UK's macro data comes upbeat, a false breakout through 1.1890 will create a sell signal with a view of catching a bearish correction and a fall to 1.1813 support. A breakout with an upward test through this barrier will generate a sell entry point with the target at around 1.1714 where it would be wiser to lock in profits. If the quote tests 1.1714, bulls will lose control over the market, which will mark the beginning of a downtrend. If GBP/USD is bullish and there is a lack of bearish activity at 1.1890, bulls will regain control over the market, and the price will soar to 1.1974. A false breakout there will create a sell entry point, and the price will go down. If there is no activity at 1.1974, GBP/USD may soar to 1.2021 where the instrument could be sold on a bounce, allowing a bearish correction of 30-35 pips intraday.

Indicator signals:

Moving averages

Trading is carried out in the area of the 30-day and 50-day moving averages, signaling a sideways trend.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

The pound will extend growth should it breakout through the upper band at 1.1870.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.