On Tuesday, the EUR/USD currency pair dropped abruptly and unexpectedly for many, dropping between 120 and 130 points. It should be noted that although the euro has traveled quite a distance, yesterday's macroeconomic environment did not support such a movement at all. Therefore, what we predicted throughout the three-week flat period came to pass. Strong statistical trends or significant fundamental events had little to no impact on how the flat ended. Only two statistics were available to dealers yesterday: the German inflation rate and the US manufacturing sector's business activity index. The American data was weaker than expected and released considerably later than the pair's decline, so it was unlikely to result in a strengthening of the US dollar. The European currency did not drop more than 100 points as a result of the German inflation report, although it showed a 1.4% y/y decline.

The euro could theoretically collapse as a result of the sharp decline in German inflation, which suggests that European inflation may also experience a significant slowdown this Friday. The likelihood of the ECB rate hike cycle finishing earlier increases with the rate at which inflation drops. The likelihood that the ECB will resume raising interest rates by 0.25% in the near future is higher. As we previously stated, market expectations for a slowing in the pace of the Fed's monetary policy tightening are the key cause of the dollar's decline during the past three months. The ECB already slowed these rates in December, and with a new decline in inflation, the likelihood of a swift and dramatic tightening of monetary policy will decrease even further. Therefore, there is no longer any need for the two to keep traveling north. It has struggled mightily to increase for the past three weeks, refusing even to slightly modify. Most likely, what we saw was an inertial movement as traders tried to take advantage of the rally in anticipation of a deeper, sustained decline in the pair. Now that we can see it, the moment may have come for the significant downward correction we have been anticipating for a while.

The movement's direction is chosen.

If we focus solely on this week's macroeconomic and structural backdrops, substantial changes can hardly be anticipated all day other than Friday. As previously stated, there were no justifications for "flights" yesterday. Only the ISM index for the US manufacturing sector is due today; however, it won't be released until later in the evening. The minutes of the Fed's meeting will be made public later that evening, but as they are a formal document, the market rarely reacts to them. What else is left for this week, then? Non-farm, the ISM service sector index, and EU inflation. This week's reports are all due on Friday. As a result, it will be challenging to predict what traders will trade actively and volatilely today and tomorrow. Or will one day suffice, and today we will once more see flat?

Now, the euro should continue to decline logically regardless of the macroeconomic or structural background. Additionally, there won't be a final one this week. The Fed is gradually beginning to awaken, and this week there are many lectures planned by Fed officials. All reports, declarations, and speeches will only occasionally steer the pair in a specific direction; ultimately, everything will depend more on the traders' decision to engage in active trading. However, even while inflation in the EU slows down very slightly on Friday and non-farm payrolls in the US are expected to be low, we continue to feel that the euro should continue to fall.

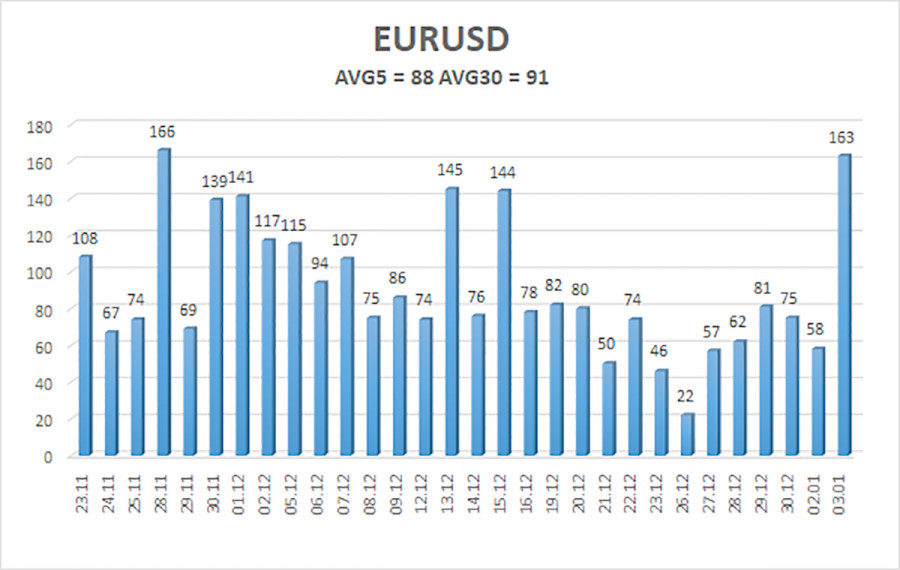

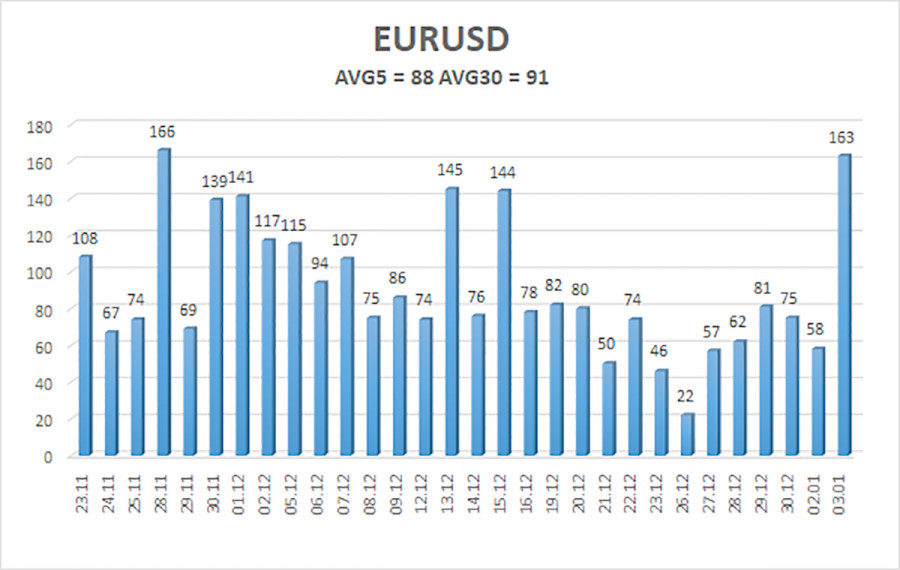

As of January 4, the euro/dollar currency pair's average volatility over the previous five trading days was 88 points, which is considered to be "normal." As a result, we anticipate that the pair will fluctuate on Wednesday between levels 1.0480 and 1.0656. A round of upward corrective will be signaled by the Heiken Ashi indicator's upward reversal.

Nearest levels of support

S1 – 1.0498

S2 – 1.0376

S3 – 1.0254

Nearest levels of resistance

R1 – 1.0620

R2 – 1.0742

R3 – 1.0864

Trading Suggestions:

The EUR/USD pair has finally resumed or at least attempted to resume, its trend movement. Until the Heiken Ashi indication turns up, you should hold short positions with objectives of 1.0498 and 1.0480. After the price reverses above the moving average, long trades should be initiated with goals of 1.0656 and 1.0742.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.