The New York Federal Reserve's Survey of Consumer Expectations showed a continuation of the trend where consumer inflation expectations have been falling. It showed that the median expected rate of inflation dropped again to 3.83% in June from May's 4.07. The inflation forecast on a three-year horizon remained unchanged at 3% in June, while the five-year indicator increased by 0.3 percentage points to 3%.

Several Fed representatives gave speeches on Monday. Meester and Daly synchronously expressed readiness to continue raising the rate and then keep it at that level to reduce inflation. Bostic from the Atlanta Fed had a less hawkish stance, noting that, although the inflation level is high, it might be better to wait a bit, as economic growth is already slowing down.

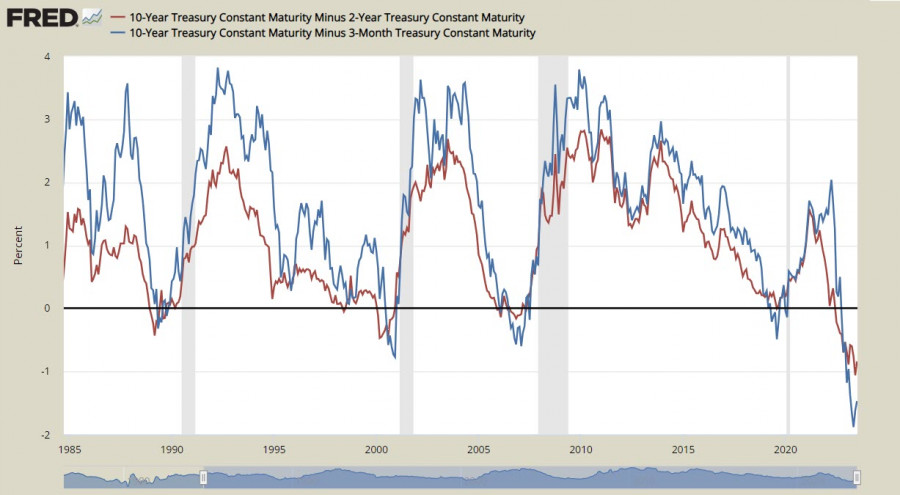

Meanwhile, the inversion of the yield curve is gaining momentum – the longer the time to maturity, the lower the yield, which is a sure sign of an approaching recession. The spread between 10-year US Treasuries and shorter-term ones has gone much lower than in all previous crises, and historical experience shows that recession comes a few months after the reversal.

Tension increased after the release of the China inflation report. Annual consumer prices were unchanged in June, weaker than the 0.2% rise in May, which turned out to be the lowest value in 28 months and raised fears about an impending deflation. The absence of price pressure in China is usually associated with a slowdown in the economy, that is, in essence, it is an indicator of a decrease in global demand.

The ZEW indicator, following Sentix, confirmed the slowdown of the eurozone's economy, as it continued to plunge to -12.2 in July 2023, down from -10 in the prior month, and the UK labor market report showed a higher-than-expected increase in wages in May, which raised the demand for the pound due to a correction of the Bank of England rate expectations in a higher direction.

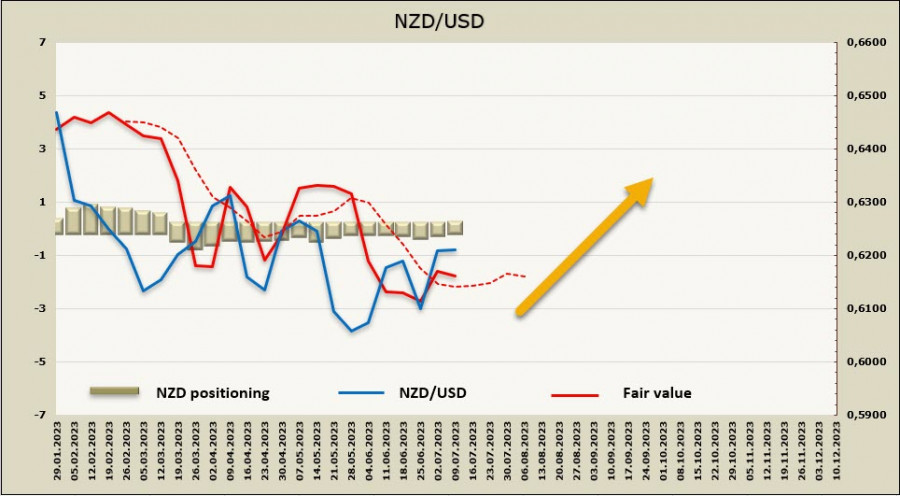

NZD/USD

The Reserve Bank of New Zealand (RBNZ) will hold its next monetary policy meeting. The rate is expected to remain unchanged, and the RBNZ will try to avoid extreme phrasing in its final statement, which will prevent forming a direction of movement in either way. It is also expected that the peak rate will rise to 5.75% by November, this forecast is already reflected in the prices.

The balance of economic news suggests that the RBNZ will not change anything. GDP for Q1 was weaker than the bank expected, business surveys showed weaker capacity pressures, inflation expectations are also falling.

New data will appear later – inflation for the 2nd quarter will be announced next week, and the labor market report even later. This data may adjust the RBNZ's position by the next meeting – demand is slowing, the economy is weaker than the Bank expected in May, and a recession seems inevitable. The question is just whether this slowdown will be enough to bring inflation back to 2%, which is still very far away.

Positioning for the NZD continues to remain neutral, speculative interest fluctuates near zero levels, the calculated price has gone above the long-term average, but has no direction.

A week earlier, we expected attempts to rise to the upper band of the corrective channel; the pair still has the opportunity to do so. If the RBNZ adds hawkish notes to its position, the pair can rise to 0.6270/90. If the results of the meeting are in accordance with the forecasts, there will be practically no reasons for growth, and in this case, a decline and gradual drift to the middle of the 0.6040/60 channel are more likely. In general, take note that there is no clear direction.

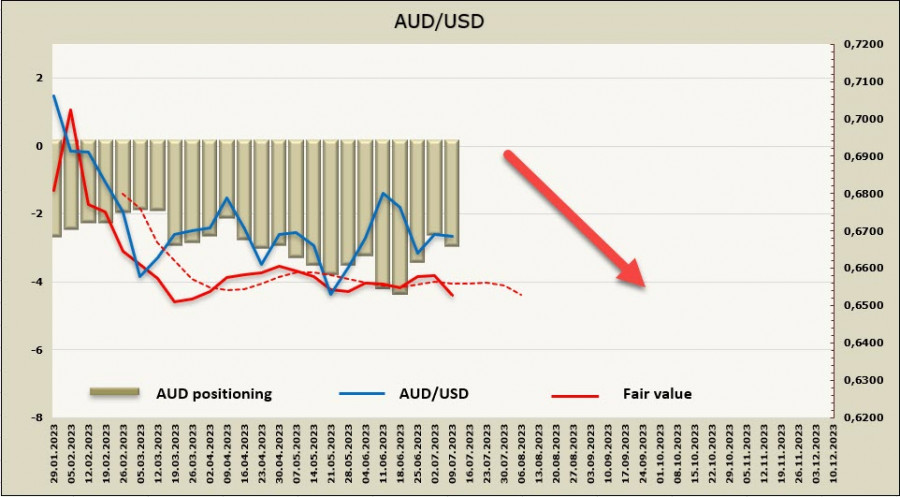

AUD/USD

The head of the Reserve Bank of Australia will speak on Wednesday at the Economic Society of Australia in Brisbane. The title of the speech is "The Reserve Bank Review and Monetary Policy", which suggests that the essence of the speech will be broader than the immediate outlook for monetary policy, but some comments on current monetary policy considerations are still likely, and the question and answer session will give another opportunity to understand whether the RBA is considering another rate hike in August.

If Lowe confirms forecasts that suggest the rate will be raised twice more to 4.60%, the speech will support the aussie. If not, or if he evades more or less direct answers, the aussie is likely to fall further.

However, it's likely that the speech will be cautious, and the market reaction moderate, since all the key economic parameters will be published later: employment for June (July 20), consumer price index for the second quarter (July 26), and retail sales (July 28). Everything comes down to the fact that it is more advantageous for the RBA to wait for new data and only then forecast its future course of action, so, most likely, the pair will continue to trade in a range.

The net short position in AUD increased by 0.3 billion over the reporting week to -2.95 billion, bearish positioning. The calculated price fell below the long-term average, it is moving downward.

AUD/USD tried to break out of the range, and it failed, so now the aussie might fall towards the support range of 0.6590/6600.