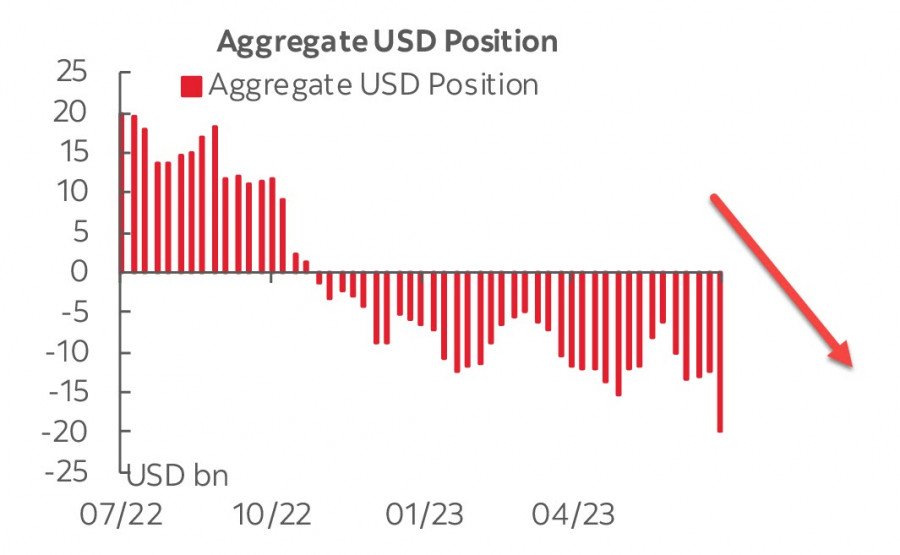

CFTC data reflects a significant deterioration in sentiment towards the US dollar. The overall short position on the USD increased by 7.39 billion during the reporting week, reaching -19.88 billion, marking the largest weekly change since 2020, and the highest bearish bias since 2021.

Significant adjustments were observed in positions on the euro and yen. In addition, it is worth noting that the net long position on gold increased by a substantial 6.231 billion, reaching 38.258 billion. Buying gold while simultaneously selling the dollar often signifies expectations that the dollar will weaken.

The Federal Reserve's rate hike on Wednesday is considered a done deal, and the market's primary focus will be on the forecasts. The Fed's main goal is to lower inflation expectations and reduce demand, so far this goal has not been achieved. Retail sales data for June indicates high consumer activity, suggesting a potential threat to the sustainability of core inflation.

The prospects for the dollar remain unclear for now. Either tightening financial conditions will lead to a sharp decline in consumption, creating conditions for a recession, or the transition will be more gradual. In the first case, the dollar will weaken, while in the second, any corrective decline may be short-lived, as the eurozone economy is closer to a recession than the US economy.

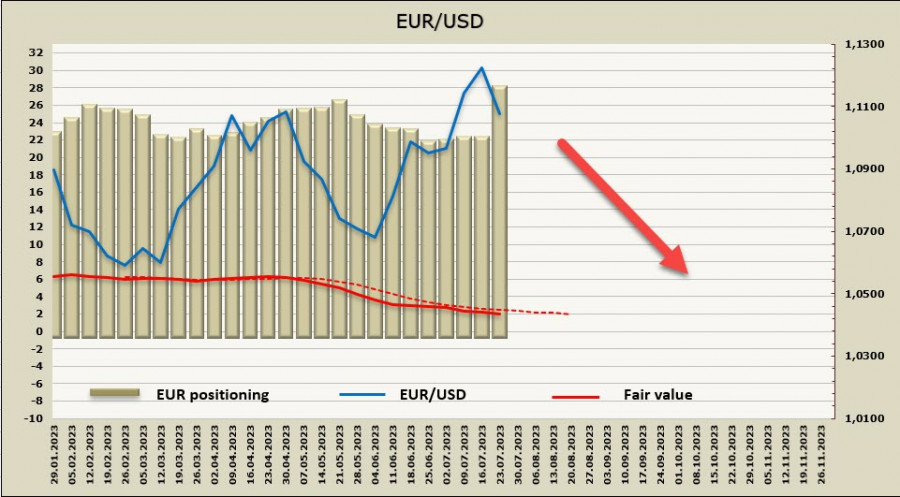

EUR/USD:

The European Central Bank meeting will take place on Thursday, and a 25 bps rate hike is considered a done deal, as Council members have repeatedly communicated in their comments. The rate hike itself is unlikely to cause a significant movement.

The main focus will be on the forecasts, from which the market will obtain information about the plans for the September meeting - either the central bank signals another rate hike, or it decides to take a pause. These post-meeting data will be the factor that either pushes the euro higher or fuels the corrective decline.

The eurozone economy is slowing down, and the PMI data published on Monday came out worse than expected in all sectors - both in manufacturing and services. The slowdown in activity suggests that inflation deceleration will continue, and the September meeting will be the last one where the ECB raises rates. If the market confirms this assumption, the euro will fall, and the uptrend will come to an end.

The net long position on the euro increased by 5.8 billion during the reporting week, marking the most significant improvement in sentiment towards the euro since September of last year. The calculated price has yet to move up.

Investors seem to be anticipating the end of the Fed's rate hike cycle, as well as the US dollar's bullish momentum. The FOMC meeting will take place on Wednesday, and the expected rate hike is already fully priced in. As a result, the yield spread will start to favor the euro, as the ECB is still far from the end of its rate cycle. It is assumed that the end of the Fed's tightening cycle will be accompanied by hawkish comments, which could push EUR/USD to fall towards the support level at 1.1010/20. Considering the significant change in sentiment on futures after the formation of a local base, the euro will likely attempt to bring back its upward movement.

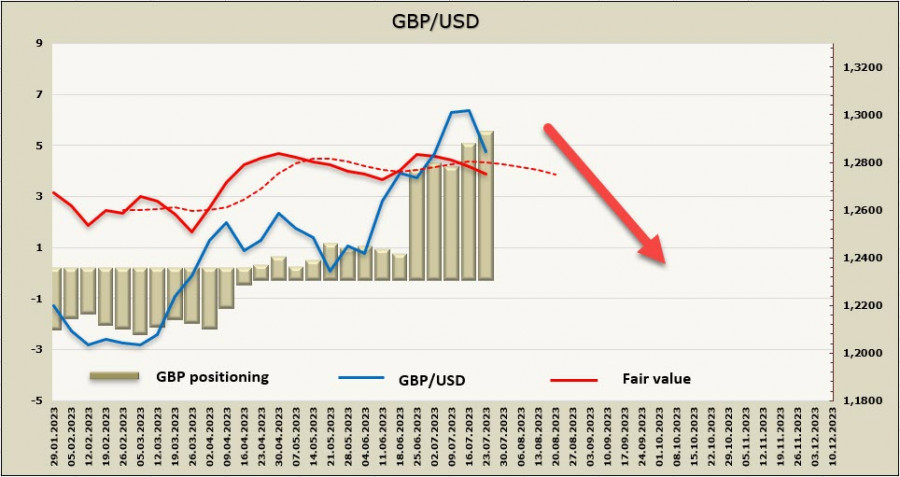

GBP/USD:

The retail sales data for June came out better than expected, supporting the pound as maintaining high consumer demand also implies the preservation of high inflation expectations and, consequently, an increase in the Bank of England's rate forecasts.

At the same time, business activity is slowing down faster than expected - the manufacturing PMI fell from 46.5 to 45 in July, while the services PMI fell from 53.7 to 51.5. The composite PMI also slowed down from 52.8 to 50.7. Considering that GDP growth is minimal and the UK economy is half a step away from a recession, maintaining high consumption while PMI activity declines implies a transition to a stagflation regime, which combines high inflation and recession. This is an awful scenario for the BoE, which they would like to avoid.

Inflation in the UK is higher than in the eurozone and the US, which suggests further rate hikes by the BoE even before the threat of a recession. This factor will support demand for the pound in the short term.

The net long position on GBP increased by 499 million during the reporting week, reaching 5.192 billion, reflecting bullish positioning. The calculated price is currently pointing downwards, which suggests an attempt to develop a corrective decline.

The pound has fallen below the support level at 1.2847, which technically indicates the possibility of a downward movement. The next support is at 1.2770/90, where the lower band of the long-term bullish channel lies. Considering that speculative positioning in futures is shifting in favor of the pound, we assume that the bearish attempts are of a corrective nature, and the pound is unlikely to fall below 1.2770. After forming a local peak, we expect the pair to resume its uptrend.