On Friday, the U.S. stock market closed with minimal changes, fluctuating between slight gains and losses. This was due to a mix of varied banking results and inflation news, increasing investors' expectations regarding a potential Federal Reserve interest rate cut.

Unexpectedly, U.S. producer prices fell in December, driven by decreased costs in goods such as food and diesel fuel, while service prices remained stable for the third consecutive month. This contrasted with higher-than-expected consumer inflation reported the previous day.

The likelihood of the Federal Reserve cutting rates in March has risen to 79.5%, up from 73.2% in the previous session, according to CME's FedWatch Tool. Friday's data also led to a decrease in Treasury yields, despite recent comments from Federal Reserve officials about a potential rate cut.

"The Producer Price Index tells us a different story compared to the Consumer Price Index," says Michael Green, Chief Strategist at Simplify Asset Management in New York. "It suggests that the Fed might be more free to decide on lowering interest rates, and the stock market is fine as long as rates don't go significantly higher."

Thus, the current dynamics in the stock market and inflation news create a unique set of circumstances for investors. On one hand, there is a risk of negative implications for certain companies, while on the other, an opportunity for the Federal Reserve to soften monetary policy, potentially supporting the market.

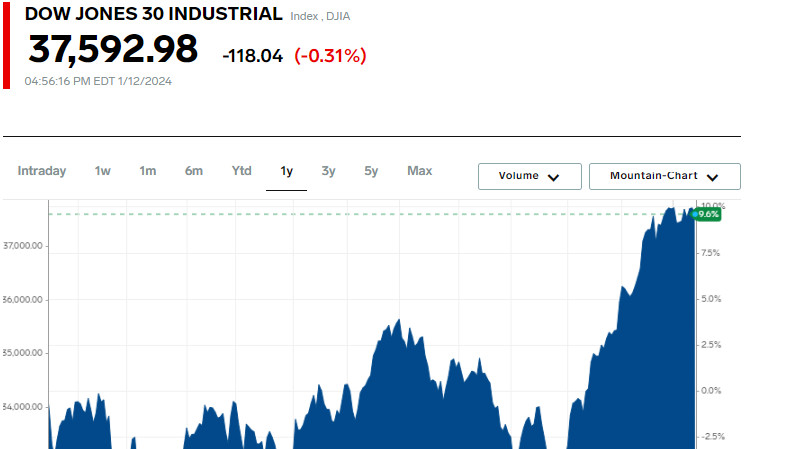

The Dow Jones Industrial Average index fell by 118.04 points, or 0.31%, to 37,592.98. The S&P 500 gained 3.59 points, or 0.08%, reaching 4,783.83, while the Nasdaq Composite rose by 2.58 points, or 0.02%, to 14,972.76.

Over the week, Dow increased by 0.34%, S&P 500 by 1.84%, and Nasdaq by 3.09%. The rise in S&P was the most significant weekly percentage gain since mid-December, and for Nasdaq, since early November.

Shares of Bank of America fell by 1.06% following a reduction in fourth-quarter profits due to one-time expenses of $3.7 billion. A warning from Wells Fargo about an expected 7-9% decline in net interest income in 2024 led to a 3.34% drop in its shares.

However, shares of Citigroup rose by 1.04% after the bank reported fourth-quarter losses of $1.8 billion and announced further job cuts.

JPMorgan Chase dropped by 0.73% despite reporting its highest annual profit in history and forecasting higher-than-expected interest income for 2024.

The S&P 500 banking index fell by 1.26% after an earlier drop of 1.7%.

The fall in the Dow index was primarily due to a 3.37% decline in UnitedHealth shares, following the company's report of higher-than-expected medical service expenses, impacting the index by approximately 120 points.

Delta Air Lines shares plummeted by 8.97% after the carrier lowered its annual profit forecast.

Tesla lost 3.67% following a price reduction for some of its new models in China and plans to halt production of most vehicles at its Berlin plant.

The energy sector fell nearly 3% since the end of October, while the S&P 500 index rose by 16%. For the entire year of 2023, the basic index grew by 24%, whereas the energy sector fell by 4.8%, marking it as the second-largest decline among S&P 500 sectors last year.

A sharp drop in oil prices was a key reason for the sector's underperformance. According to investors, U.S. oil prices fell more than 20% since the end of September, to around $73 per barrel, pressured by robust supplies, especially in the U.S., and concerns about weak demand in China and Europe.

Potential growth in tensions in the Middle East and any actions by OPEC regarding production are factors that could influence short-term oil prices.

U.S. oil prices jumped 4.5% on Friday and then rose by 0.9% after several oil tankers diverted from the Red Sea following overnight air and sea strikes by the U.S. and Britain on Houthi targets in Yemen. Energy sector shares ended the day up by 1.3%.

The energy sector is expected to show the worst profit performance in 2023 among all sectors, falling nearly 26%, according to LSEG data. However, its revenues are expected to grow by 1.6% in 2024.

On the New York Stock Exchange, the number of advancing stocks exceeded the number of decliners in a ratio of 1.4 to 1, while on Nasdaq, decliners outnumbered advancers in a ratio of 1.1 to 1.

The S&P index recorded 37 new 52-week highs and no new lows, whereas Nasdaq posted 134 new highs and 86 new lows.

Trading volume on U.S. exchanges amounted to 10.57 billion shares, compared to the average of 12.06 billion over the last 20 full trading days, indicating the variability of market sentiments and the dynamics of supply and demand in the stock market.