Experts are looking forward to the release of the US personal consumption price (PCE) index this Friday, which is a key indicator for the Federal Reserve System (Fed).

The data is expected to provide insight into future interest rate movements for the remainder of the year. Markets have already adjusted to the possibility of a rate hike, based on recently released Fed meeting minutes and muted comments from officials expressing doubts about a sustained decline in inflation.

Earlier this month, separate reports showed moderate growth in consumer prices, which was below expectations. This has raised hopes of a possible rate cut this year after months of higher inflation.

Minutes of the Fed's latest meetings confirmed that regulators expect price pressures to ease, although they cautioned that it will be necessary to wait several months before they can be sure that the 2% inflation target has been achieved before undertaking new economic initiatives.

This week, market participants will expect a series of speeches from a number of key figures from the Federal Reserve, including Michelle Bowman, Loretta Mester from the Cleveland Fed, Lisa Cook, John Williams from the New York Fed and Raphael Bostic from the Atlanta Fed. These events will provide investors with additional guidance regarding the current economic climate.

Also included in the economic agenda are updated estimates of first-quarter U.S. economic growth due Thursday, as well as the Federal Reserve's Beige Book report scheduled for Wednesday. These data will provide additional information about the state of the economy, which could influence future monetary policy decisions.

At the upcoming June meeting, the European Central Bank (ECB) is likely to take steps to cut interest rates from the current record level of 4%. However, the pace of further rate cuts remains an open question, especially in the context of upcoming eurozone inflation data on Friday, which could indicate continued price pressures.

Eurozone inflation is expected to rise to 2.5% per annum in May from 2.4% in April, while core inflation will remain at 2.7%. This should not prevent the ECB from cutting rates in June, although some officials have spoken out against further easing of monetary policy.

Next week will also see the release of important economic data for the eurozone, including the Ifo business climate index in Germany on Monday and the ECB's survey of inflation expectations on Tuesday.

Market attention is focused on the upcoming inflation data in Tokyo, which will be published this Friday. Analysts and investors are analyzing this data in an attempt to predict possible changes in the Bank of Japan's monetary policy, especially in the context of the expected next interest rate hike.

This publication will take place two weeks before the Bank of Japan meeting, at which, as experts suggest, a second rate hike may occur after a significant decision in March. The country is under growing pressure on the central bank to raise rates as the yen continues to weaken, raising the cost of imported goods and weighing on consumer demand.

Also this Friday, the Japanese Ministry of Finance will present data on the latest interventions in the foreign exchange market and changes in the bond purchase schedule of the Bank of Japan. Investors will be closely watching for a possible reduction in purchases by the central bank.

Early in the week on Monday, China will release industrial profit data for the past year, allowing analysts and investors to assess whether April's performance recovered from a big drop in March. The drop weighed on the country's economic growth in the first quarter, which slowed to 4.3%.

The official PMIs for the manufacturing and non-manufacturing sectors will be released on Friday. Economists forecast that the manufacturing PMI should exceed the threshold of 50 for the third time in a row in May, indicating growth in the sector.

Beijing has set an ambitious target for economic growth of around 5% this year, but many experts say that target is difficult to achieve. Continued difficulties in the real estate sector and weak consumer demand continue to be major headwinds for the world's second-largest economy.

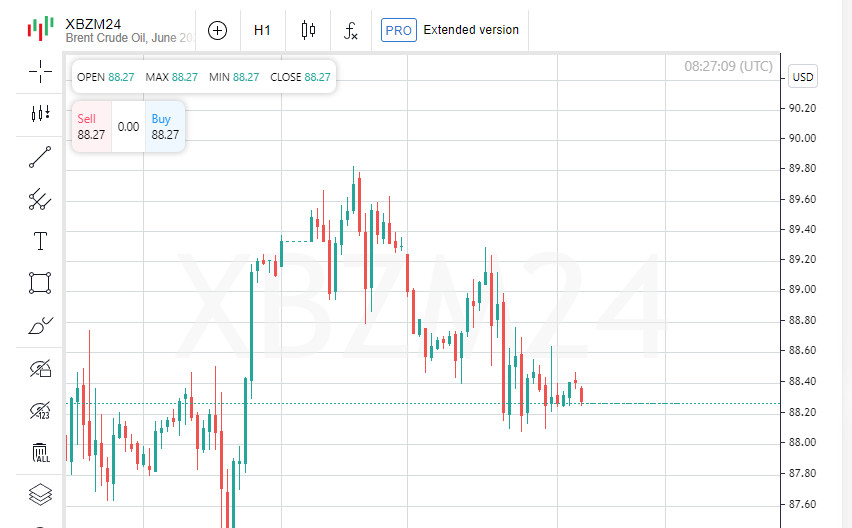

Oil prices rose 1% on Friday, but ended the week in the red on expectations that strong economic growth in the US could keep interest rates high for an extended period, which in turn would weigh on fuel demand.

Brent prices fell 2.1% during the week, marking the largest number of consecutive declines since early January. The US WTI fell 2.8% for the week.

High interest rates lead to rising borrowing costs, which could limit economic activity and reduce demand for oil. However, overall oil demand remains high, according to Morgan Stanley analysts.

They estimate that global consumption of liquid petroleum products will increase by about 1.5 million barrels per day this year.

Weak demand for gasoline in the United States is compensated by an increase in global demand, especially noticeable at the beginning of the year, experts emphasize.