The GBP/USD pair also started a corrective movement on Wednesday, which looks logical no matter how you look. First, a correction was necessary after a strong rise of almost 250 points on Tuesday. Second, the report on American inflation could have been more resonant for the dollar to lose 200 points in just a few hours. Third, the report on British inflation published yesterday was even more resonant than the report on inflation in the United States. Fourth, the CCI indicator entered the overbought zone for the third time. There were enough reasons for the pair to fall, and we believe it should be much stronger than it is now.

Although we have been observing an upward correction in the British pound for one and a half months, all movement still looks like "swings." It's just "swings" on the "flat-shaped," but upward. The pair often corrects deeply and frequently within the framework of an upward correction. Therefore, in any case, we do not expect a strong medium-term rise from the pound. It is also worth remembering that two of the last two waves of strengthening the British currency were provoked by weak statistics from across the ocean. The Nonfarm and inflation reports were not so disastrous and resonant for the dollar to collapse twice a row like a stone. This is a sign that the market wants to correct the pair slightly to sell at more profitable prices.

Anyway, the triple overbought condition of the CCI indicator indicates a lack of growth prospects. Of course, any indicators make mistakes from time to time. The market has many players, and not all aim to profit from their currency operations. Therefore, movements can be unpredictable. However, technical and fundamental analysis has yet to be canceled. Technically, it is now time for a serious downward correction. Fundamentally, there is no basis for the growth of the British currency.

British inflation scared Andrew Bailey.

The Consumer Price Index in the UK for October fell to 4.6%. If you do not look at the forecast and the previous value, it may be unclear what is special about this figure. However, in September, inflation was 6.7%, and within one month it slowed down by 2.1%, which is a lot. Naturally, all forecasts were exceeded, and the pound sterling began to decline. By the way, it was not as strong as the American dollar the day before. Since inflation in the UK has already fallen below 5%, as Andrew Bailey mentioned, expecting a new tightening from the Bank of England soon makes no sense. Even before the last inflation report, representatives of the British regulator have repeatedly stated that the rate will remain at its maximum value for a long time, and this is how the BoE plans to return inflation to the target level. Therefore, if someone believed in a new rate hike, then after yesterday's report, this belief should have been shattered to pieces.

It is now very difficult to expect a new tightening from the Fed, and the fundamental background for the dollar and the pound is currently in balance. And when the foundation says nothing, you must focus entirely on the technique. The triple overbought condition of the CCI indicator is the starting point for a fall. The price settling below the moving average is the next signal for sales. The price rebound from the Senkou Span B line in the 24-hour timeframe is another signal for a possible decline. The price settling below the critical line on the daily chart confirms the resumption of the downward trend. The MACD indicator on the daily timeframe has discharged enough and can now fall again.

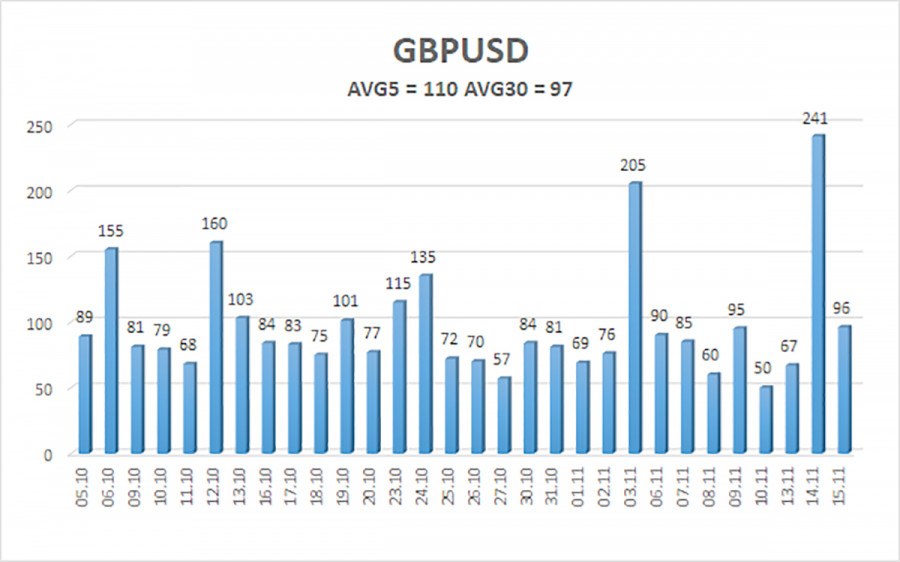

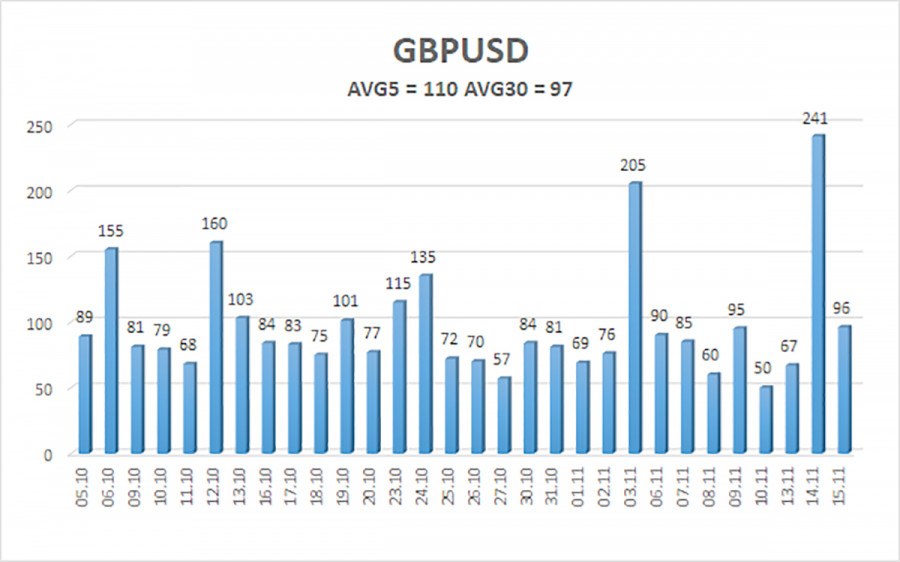

The average GBP/USD pair volatility for the last five trading days as of November 16 is 110 points. For the pound/dollar pair, this value is considered "average." Therefore, on Thursday, November 16, we expect movement within the range limited by the levels of 1.2284 and 1.2504. The reversal of the Heiken Ashi indicator upwards will indicate a new upward correction.

Nearest support levels:

S1 – 1.2390

S2 – 1.2329

S3 – 1.2268

Nearest resistance levels:

R1 – 1.2451

R2 – 1.2512

R3 – 1.2573

Trading recommendations:

The GBP/USD currency pair has started a new downward movement but is still above the moving average. Short positions can be opened with targets at 1.2268 and 1.2207 if the price settles below the moving average. Long positions can technically be considered, as the price is above the moving average, with targets at 1.2451 and 1.2504. Still, the triple overbought condition of the CCI indicator indicates the danger of opening such deals.

Explanations for illustrations:

Linear regression channels help determine the current trend. The trend is currently strong if both are directed in the same direction.

The moving average line (settings 20,0, smoothed) determines the short-term trend and the direction in which it is currently advisable to trade.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator entering the oversold zone (below -250) or overbought zone (above +250) indicates that a trend reversal in the opposite direction is approaching.