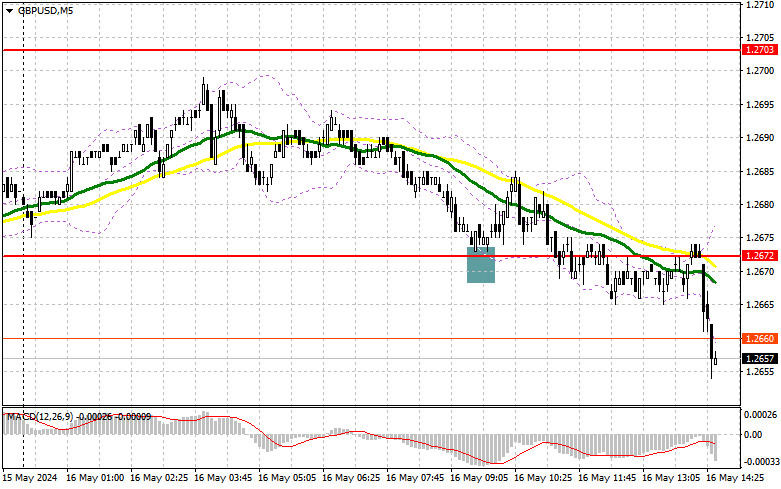

In my morning forecast, I paid attention to the level of 1.2672 and planned to make decisions based on it for market entry. Let's look at the 5-minute chart and figure out what happened there. The decline and the formation of a false breakout signaled a buy, but after a 15-point upward movement, pressure on the pair returned. For the second half of the day, the technical picture was reassessed.

To open long positions on GBP/USD, the following is required:

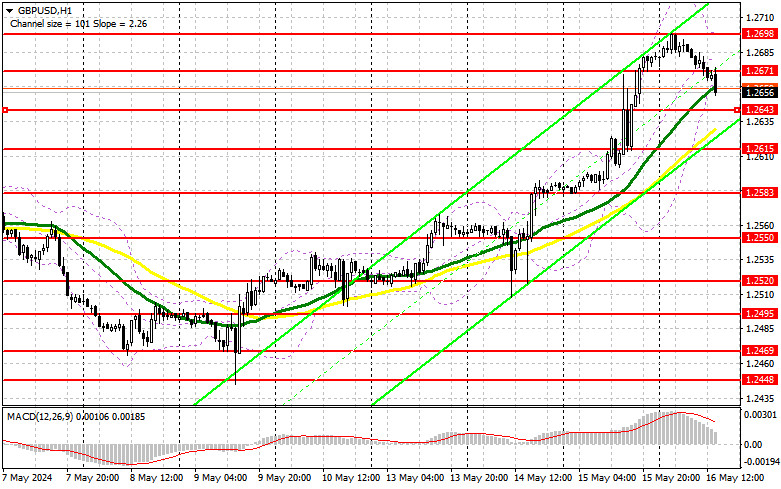

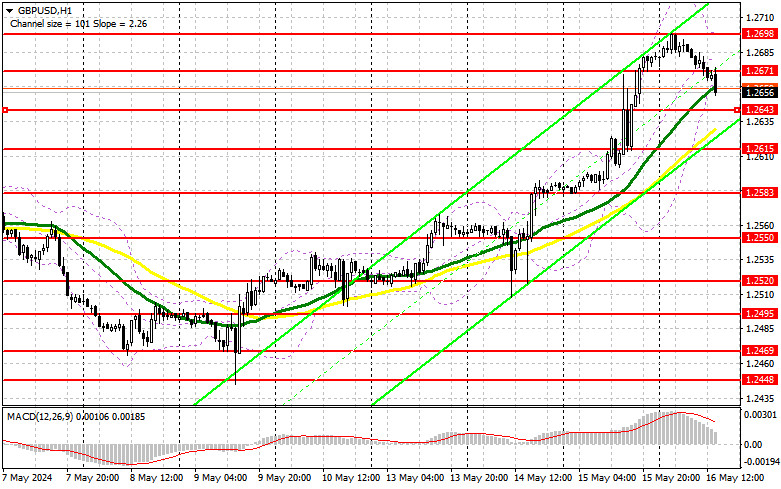

The lack of data from the UK did not help pound buyers today, who had already lost part of yesterday's positions gained after weak US inflation statistics. Sellers may entirely dominate the second half of the day, but everything will depend on the statistics. We are awaiting figures on initial jobless claims, the Philadelphia Fed Manufacturing Index, and data related to real estate. Most likely, it will be the data on the number of new housing starts and building permits issued that could lead to a surge in volatility, and a good report on changes in industrial production could lead to a larger decline in GBP/USD in continuation of the morning trend. For this reason, in the current situation, I plan to buy the pound only after the support at 1.2643 is defended - the support formed based on yesterday's results. A decline and formation of a false breakout will provide an entry point for long positions capable of pushing the pound towards 1.2671. Only a breakout and a test from top to bottom of this range against the backdrop of weak US data - a chance for GBP/USD to rise with a refresh to 1.2698 - the monthly high. If it exceeds this range, we can talk about a surge to 1.2734, where I plan to profit. In the scenario of GBP/USD decline and the absence of buyers at 1.2643 in the second half of the day, where the moving averages intersect, pressure on the pound will return, leading to a downward movement towards 1.2615. The formation of a false breakout will be a suitable option for market entry. I plan to open long positions on GBP/USD immediately on a rebound from 1.2583, with a target of a correction of 30-35 points within the day.

To open short positions on GBP/USD, the following is required:

If US data on the labor market and construction is better than economists' forecasts, the pair's decline will continue, and bears will regain what they lost yesterday. In case of a bullish reaction to the data, I plan to act around the new resistance at 1.2671. Formation of a false breakout there will provide an excellent entry point for short positions with the prospect of further decline of GBP/USD towards 1.2643. However, a breakout and reverse test from the bottom to the top of this range will increase pressure on the pair, giving bears an advantage and another selling point to update 1.2615. Beyond this level, a real struggle will unfold. The more distant target will be the minimum of 1.2583, which will negate all the efforts of pound buyers this week. I will make a profit there. In the scenario of GBP/USD rise and the absence of bears at 1.2671 in the second half of the day, and since the bull market has not been canceled yet, buyers will have the opportunity to continue the upward trend and refresh the level of 1.2698. I will also sell there only on a false breakout. In the absence of activity, I advise opening short positions on GBP/USD from 1.2734, counting on a pair rebound downwards by 30-35 points within the day.

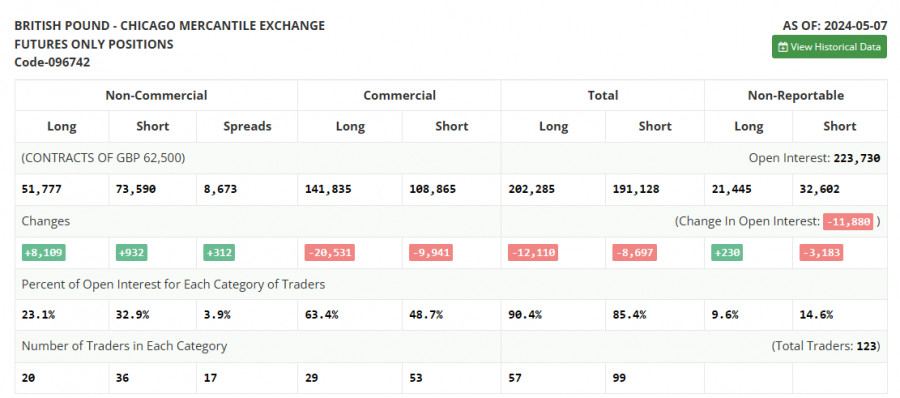

In the COT report (Commitment of Traders) for May 7th, there was an increase in both long and short positions. Pound buyers were much more than sellers, all thanks to the Bank of England meeting. The regulator did everything to prepare the markets for a future interest rate cut this summer. And though it was supposed to weaken the pound, traders responded to everything with growth in the current situation of a problematic economy. The latest GDP and inflation data allow the Bank of England to begin easing policy, which will benefit consumers and businesses, and the pound in the medium term will respond with strengthening. The latest COT report states that long non-commercial positions increased by 8,108 to 51,777, while short non-commercial positions jumped by 932 to 73,590. As a result, the spread between long and short positions increased by 312.

Indicator Signals:

Moving Averages

Trading is conducted above the 30 and 50-day moving averages, indicating further pound growth.

Note: The author considers the period and prices of moving averages on the hourly chart H1, which differs from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decline, the indicator's lower boundary, around 1.2655, will act as support.

Indicator Descriptions:

- Moving Average (determines the current trend by smoothing out volatility and noise). Period 50. Marked on the chart in yellow.

- Moving Average (determines the current trend by smoothing out volatility and noise). Period 30. Marked on the chart in green.

- MACD Indicator (Moving Average Convergence/Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands. Period 20.

- Non-commercial traders are speculators, such as individual traders, hedge funds, and large institutions, who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between non-commercial traders' short and long positions.