To open long positions on GBP/USD, it is required:

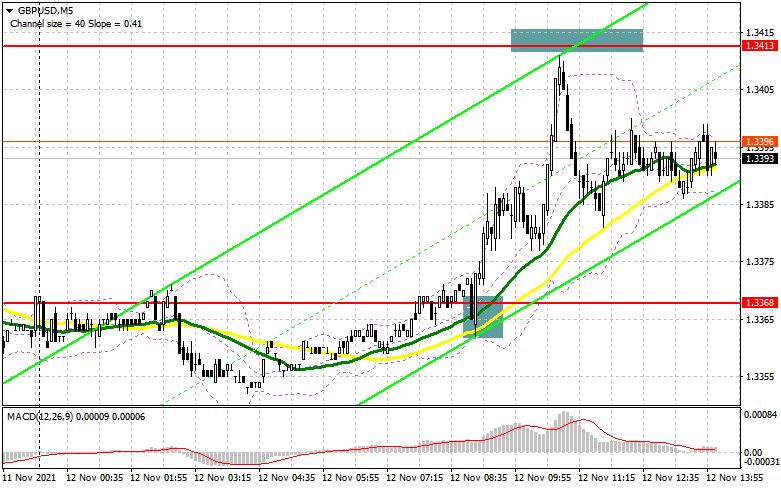

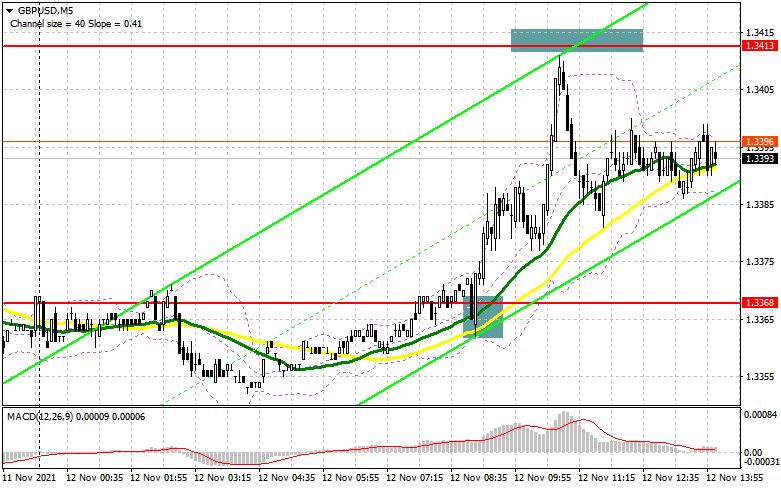

In my morning forecast, I paid attention to the level of 1.3368 and recommended opening long positions from it. Let's look at the 5-minute chart and figure out the deals. A breakthrough and a reverse test of this area from top to bottom at the very beginning of the European session led to the formation of a signal to open long positions. As a result, the movement of GBP/USD up amounted to about 40 points, but it was not enough until the 1.3413 level was updated. Therefore, it was not possible to get a convenient entry point from there into short positions.

Now the focus of the bulls will be on weak data on the consumer sentiment index and the inflation expectations index from the University of Michigan. Only a sharp reduction in these indicators will continue the upward correction of the pound, and will also help the bulls to protect the support of 1.3377 formed in the first half of the day. However, the developing situation around the Brexit agreement does not add confidence to buyers. If the British continue to insist on renegotiating the agreement, a new decline in the pound will not have to wait long. The main task of the bulls for the second half of the day will be to protect the new support of 1.3377. Only the formation of a false one there will give a signal to buy the pound against the trend – this will return the chance for an upward correction of the pair to the area of 1.3423. An equally important task will be to control this level. A breakthrough and a reverse test from top to bottom will lead to a new signal to buy the pound, which will push GBP/USD up to 1.3469 with the prospect of reaching a maximum of 1.3522, where I recommend fixing the profits. In the scenario of a decline in the pair in the afternoon and the deterioration of the situation around Brexit, the best option for buying the pound will be a support test of 1.3308. However, I advise you to open long positions there only after a false breakdown. You can watch GBP/USD purchases immediately for a rebound from the new low of 1.3254, or even lower - from the support of 1.3193, counting on a correction of 25-30 points within the day.

To open short positions on GBP/USD, you need:

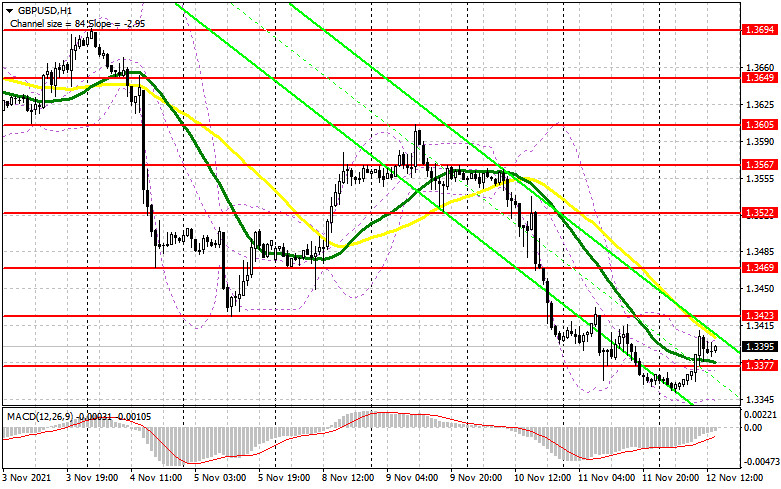

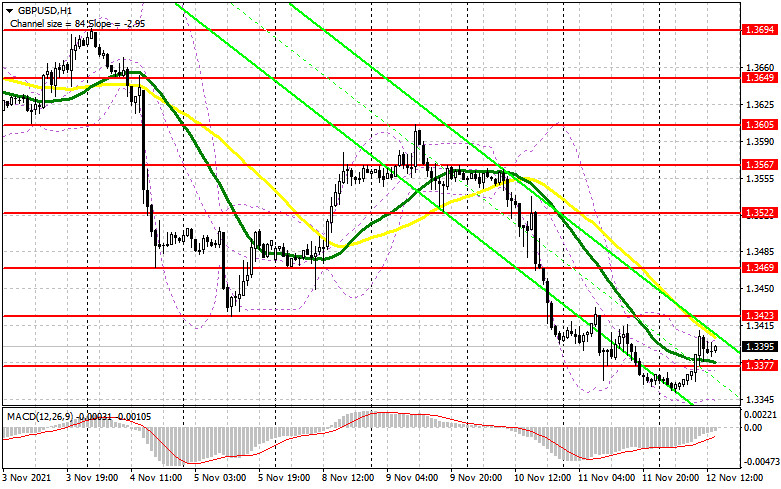

The bears failed to cope with the tasks assigned to them, but it is still very early to panic. All sellers need now to continue the downward trend is a breakout and a reverse test of the 1.3377 level, which they missed in the first half of the day. Strong data on the US economy can help with this. The bottom-up test of 1.3377 forms a signal to open new short positions to reduce to a minimum of 1.3308. The breakdown of 1.3308 forms an additional point for opening short positions to reach 1.3254 and 1.3193, where I recommend fixing the profits. If the pair grows during the American session, the formation of a false breakdown in the area of 1.3423 will give an excellent signal to sell the pound. If we see GBP/USD rise above this level, it is best to postpone short positions to a larger resistance of 1.3469. I advise you to open short positions immediately for a rebound from 1.3522, or even higher - from a new maximum in the area of 1.3567, counting on the pair's rebound down by 20-25 points inside the day.

The COT reports (Commitment of Traders) for November 2 recorded an increase in both short and long positions, which reflected the return of demand for the British pound before the meeting of the Bank of England, which took place last week. Given that there were more buyers and they continue to return to the market, we can count on the continuation of the upward correction of the pair. This week, many representatives of the Bank of England are speaking, who are already beginning to make statements to the contrary, disagreeing with the policy of Governor Andrew Bailey. Let me remind you that after the November meeting of the Bank of England, monetary policy remained completely unchanged, although many traders bet on its tightening by the end of the year. In this regard, sharp inflationary pressure will continue to support demand for the British pound. Therefore, I recommend sticking to the strategy of buying the pair in case of very large falls, which will occur against the background of uncertainty in the policy of the Central Bank. The COT report indicates that long non-profit positions increased from the level of 51,912 to the level of 57,255, while short non-profit positions also strengthened slightly, from the level of 36,959 to the level of 42,208. This led to a change in the non-commercial net position towards growth. The delta was 15,047 against 14,953 a week earlier. The weekly closing price of GBP/USD has significantly collapsed as a result of the policy of the Bank of England - from 1.3763 to 1.3654.

Signals of indicators:

Moving averages

Trading is conducted around 30 and 50 daily moving averages, which limits the upward potential of the pair.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A breakthrough of the upper limit of the indicator in the area of 1.3402 will lead to a new wave of growth of the pound. In case of a decline, the lower limit of the indicator in the area of 1.3345 will act as support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.