There is a rapid growth in demand for risk on the global markets, the stock indices of the US and Asia-Pacific countries are gaining 2-3% each, oil has recovered a significant part of the losses, and iron ore is adding more than 3%. Everything is due to the fact that the Omicron strain poses a much lower health threat than previous options despite its high resistance. This, in turn, means a sharp decrease in the probability of the global economy returning to a regime of restrictions.

In general, such a sharp reversal to the demand for risk is unexpected for the markets, since large speculators were preparing for a different scenario. Over the past few weeks, analysis of CFTC reports shows that oil futures peaked in early November, and the number of short contracts has been growing for 5 weeks in a row. The same applies to all commodity currencies without exception. The markets will need some more time to reposition. As for the prospects for the coming days, the demand for risk will remain the dominant trend, which will most likely lead to the growth of commodity currencies and the suspension of the US dollar's growth.

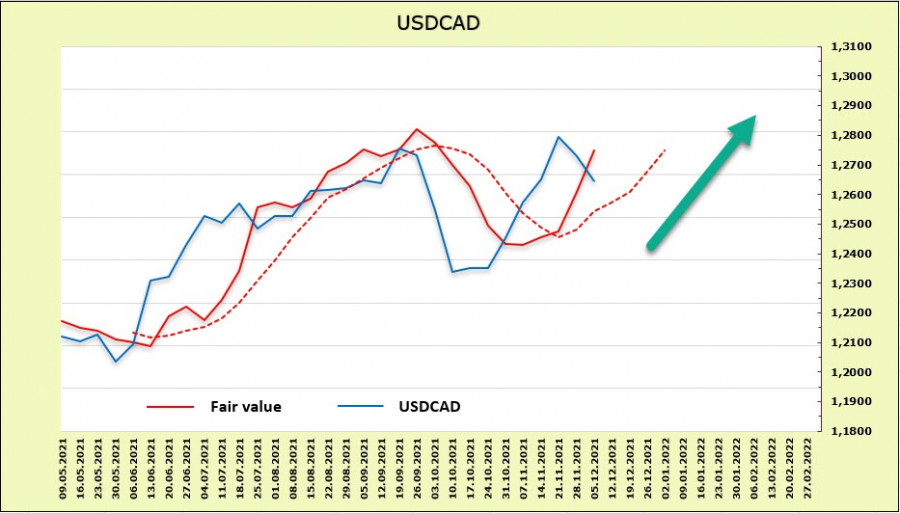

USD/CAD

Today, the Bank of Canada will hold a regular meeting on monetary policy. The risk that the rate will be raised from the current 0.25% is small, although it should be noted that there is still a small probability. A number of key macroeconomic parameters of Canada look convincing.

GDP recovered quickly in the third quarter after the recession in the second quarter, increasing by 5.4% year-on-year. The rise was facilitated by an increase in consumer spending (+18% yoy), and if it were not for supply chain disruptions that slowed down the manufacturing sector, even stronger results could have been expected.

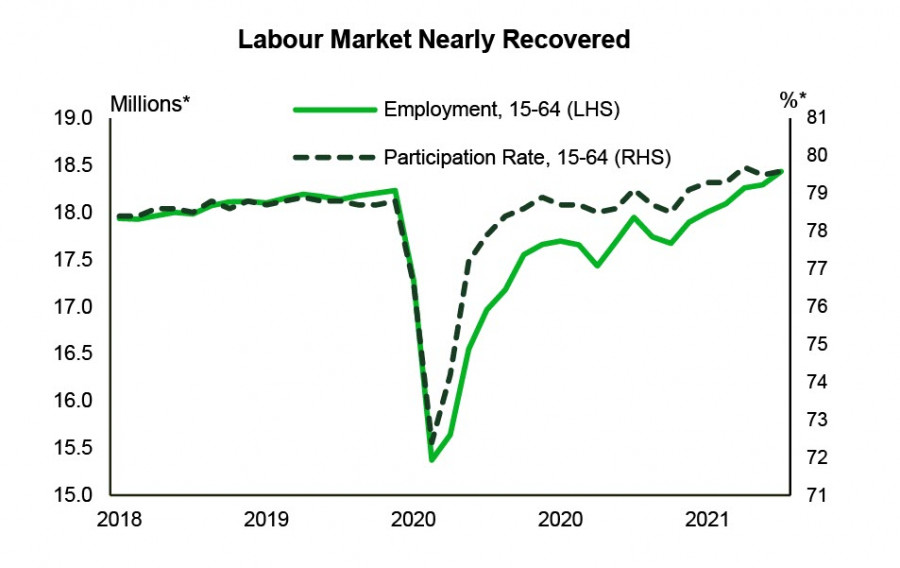

The labor market is also recovering rapidly – employment in November increased by 154 thousand and is already 1% higher than the pre-pandemic level.

The unemployment rate dropped to 6%, the number of hours worked also returned to pre-pandemic levels. BoC will not be able to ignore such a strong report. The bank has repeatedly stressed earlier that it will keep the overnight rate at a low level until the labor market recovery is completed. Well, the goal has been achieved, so what's next?

It is very possible that the Bank of Canada will refer to the uncertainty with Omicron, but the probability that the rate will be raised in January is getting higher. If the markets regard the Canadian's prospects in this way, then we should expect an increase in the long CAD position in the upcoming CFTC reports. In the meantime, the figures are against it – according to the latest report, the net short position has grown by 854 million to -1.101 billion. The estimated price is confidently directed upwards, so any downward movement should be considered corrective.

The demand for risk in the last two days allowed USD/CAD to pull back to the support zone of 1.2630/40, the next support is 1.2560. It can be assumed that growth may resume from the current levels, the target of 1.30 is still relevant.

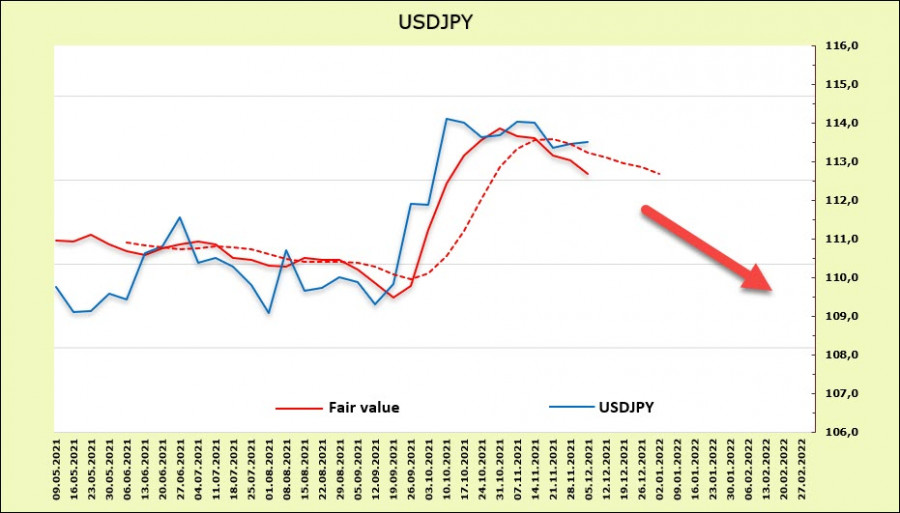

USD/JPY

The Japanese economy is still quite far from a state in which it is possible to assume some kind of reduction in incentives, and it is unknown whether such a state will occur at all since the financial authorities are considering at the current stage exclusively questions about additional costs, and not about cuts.

This morning, the Cabinet of Ministers published the second preliminary estimate of GDP for the 3rd quarter. The real GDP growth has been revised downward from -0.8 to -0.9% q/a, real GDP is about 1.9% lower than in Q4 2019. The economy remains vulnerable. The dynamics are such that there is no probability of a reduction in the supply of the yen, so there are no reasons for strengthening the yen.

But as for the yen's positions in the futures market, we are likely seeing a change in direction. The net-short position declined by 1.847 billion during the reporting week, which is quite a lot, and reached -8.711 billion. The bearish advantage is still significant, but it is shrinking rapidly. The estimated price is still directed downward.

We expect that the multi-directional pressure on the yen will not allow it to go beyond the range in the coming days. It is likely to trade in a horizontal channel with support of 113.02 and resistance of 114.04, going beyond the channel upwards is possible if the demand for risk continues to grow.