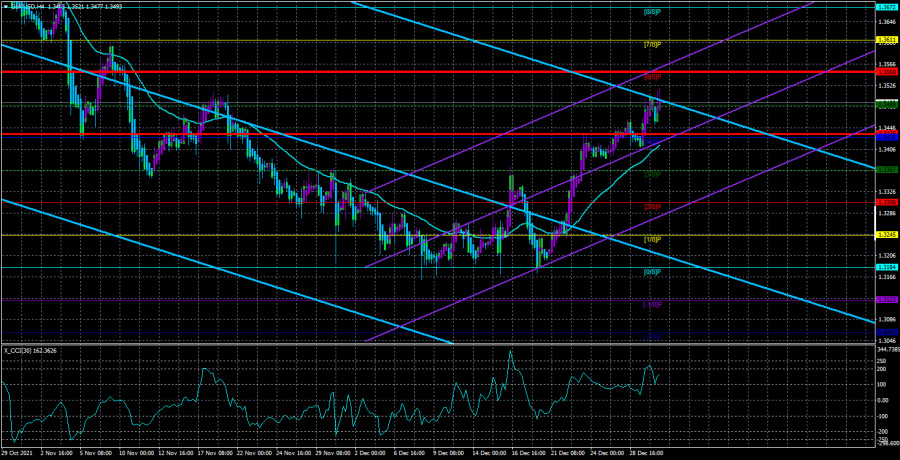

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - upward.

The GBP/USD currency pair on Thursday again tried to start a round of downward correction, but in the afternoon it began to grow again. Thus, even in the last days of the outgoing year, the British currency continues to grow against the US dollar, although before the start of this movement for several months, the markets did not find any reason to buy the pound. However, we remind you that technical factors speak in favor of the growth of the British currency. In particular, the rebound on the 24-hour timeframe from the 38.2% Fibonacci level. An ascending trend line has been formed on the hourly TF and continues to be relevant. And at a 4-hour timeframe, the junior channel of linear regression is directed upwards. As in the case of the euro currency, the pound may grow now because the markets have already fully worked out the factor of tightening the Fed's monetary policy. And it can grow based on the factor of the increase in the key rate by the Bank of England. One could try to guess what the monetary policy of both central banks will be in 2022, but the Omicron factor can make serious adjustments to the plans of the Fed and the BA. Thus, it is at least impractical to assume now how the monetary policy of both banks will change next year. Assuming that everything goes according to plan, then the US dollar should resume growth. In this case, everything, in general, can turn out very nicely. Earlier, we have repeatedly said that the pound/dollar pair should go up by 400-500 points since deep corrections correspond to the nature of the pair's movement in 2021. There are no good reasons for the pound to grow in the long run, so the downward trend may resume in 2022. But for this, it is necessary that at least the Fed continues to tighten its policy.

And what about the geopolitical and political factors?

In principle, a lot has already been said on this topic. The UK continues to be the number one provider of negative news in the world. It has problems in politics, problems in geopolitics, problems in economics. The figure of Boris Johnson is as similar as possible to Donald Trump. At least because the British prime minister uses similar methods and even looks a little like him in appearance. Therefore, we would not be surprised if everything ends up about the same for Johnson as for Trump. Namely, by not being re-elected for a second term. Or maybe early retirement. The fact is that Boris Johnson's political ratings are already "below the plinth". The opposition openly opposes him, the British people do not support him, and, according to rumors, even the Conservatives are ready to abandon their leader. Thus, a new political crisis may be brewing in the Kingdom. Johnson is more remembered in his post for the unimaginable number of scandals in which he was involved, rather than victories at the state level. Perhaps, of the victories, only a completed Brexit can be imputed to him.

In addition, the country may face new geopolitical problems. Recall that Scotland intends to leave the Kingdom, and the corresponding referendum should be held within the next two years. At least, this is the promise made by Nicola Sturgeon, the First Minister of Scotland. And so far, everything is going to ensure that by hook or by crook Edinburgh will hold this referendum, and its legitimacy will be decided in the courts. After all, it is clear to everyone that Boris Johnson will not permit to hold another referendum (the last one took place in 2014). Potentially, this means that Britain could lose a third of its territory if the Scottish people express a desire to leave the Kingdom and return to the Alliance. Not to mention the economic losses. It should also be noted that Johnson has not yet managed to reconcile with Scotland and convince her to stay. So far, it looks like London is keeping Edinburgh shackled to itself. However, the Scottish people may vote "against" leaving the UK for the second time in the last 10 years.

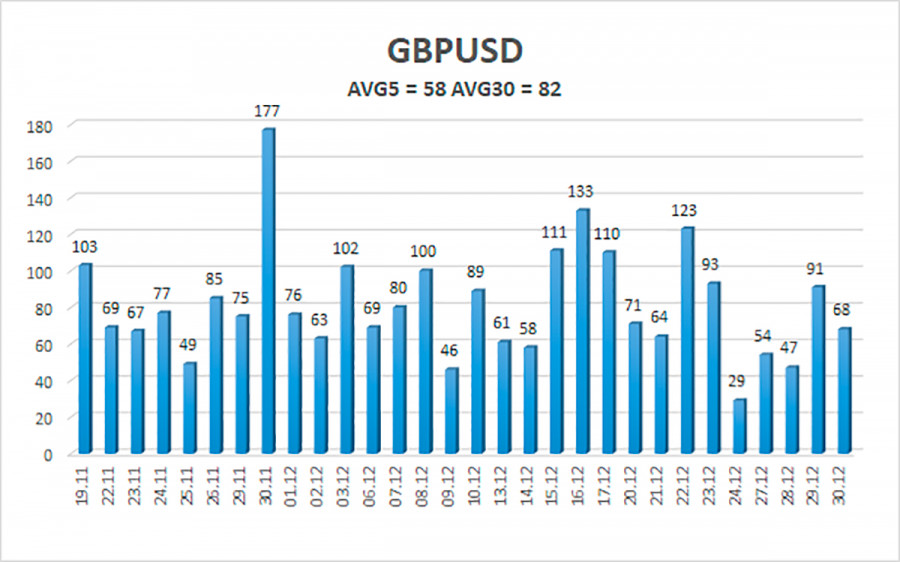

The average volatility of the GBP/USD pair is currently 58 points per day. For the pound/dollar pair, this value is the average. On Friday, December 31, we expect movement inside the channel, limited by the levels of 1.3425 and 1.3551. The reversal of the Heiken Ashi indicator downwards signals a new round of downward correction.

Nearest support levels:

S1 – 1.3428;

S2 – 1.3367;

S3 – 1.3306.

Nearest resistance levels:

R1 – 1.3489;

R2 – 1.3550;

R3 – 1.3611.

Trading recommendations:

The GBP/USD pair broke out of the side channel on the 4-hour timeframe and continues its strong upward movement. Thus, at this time it is possible to stay in the longs opened after a new reversal of the Heiken Ashi indicator upward. The targets are 1.3550 and 1.3611. Exit the longs if the Heiken Ashi indicator turns down. Short positions should be considered if the pair is fixed back below the moving average with targets of 1.3367 and 1.3306.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, it means that the trend is now strong;

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now;

Murray levels - target levels for movements and corrections;

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators;

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.