Analysis of EUR/USD and trading tips

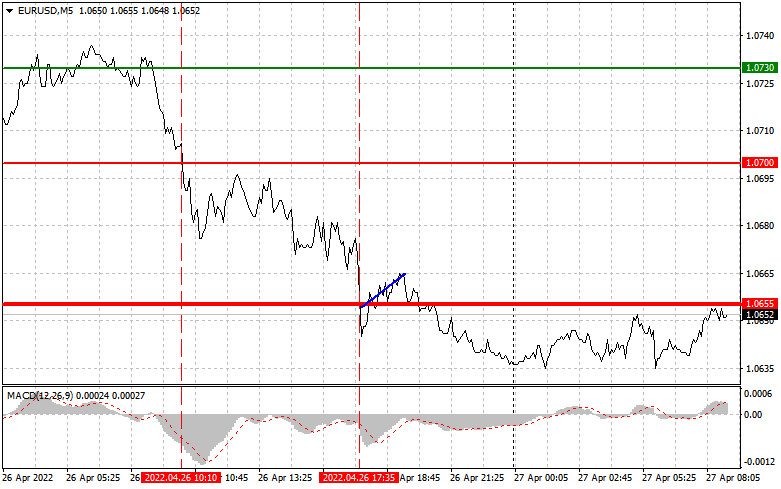

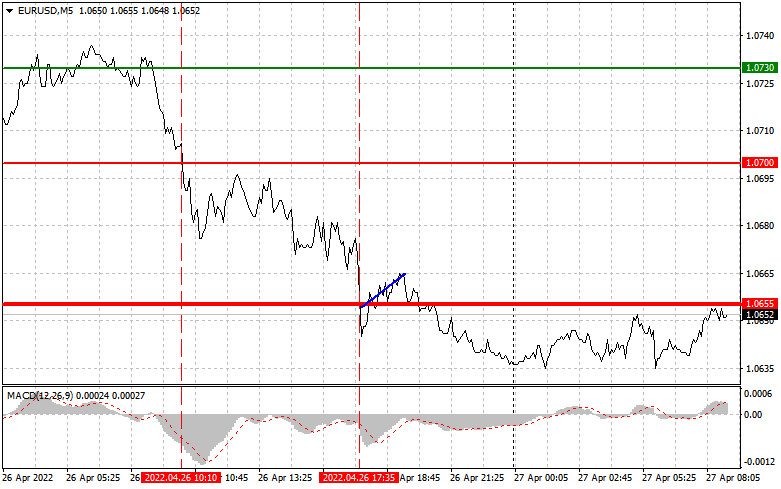

The euro/dollar pair tested the level of 1.0700 when the MACD indicator was far from the zero level. This fact limited the pair's downward potential regardless of the bearish trend. That is why I decided not to open sell orders on the euro, but this was a mistake. The pair continued falling and hit 1.0655. Buy positions from this level presented in scenario 2 did not bring significant profit as the pair rose just by 12 pips. In addition, there were no other entry points.

Absence of macroeconomic reports from the eurozone in the first part of the day allowed the euro to remain under pressure. At the same time, strong data on the US consumer confidence index and new home sales accelerated the euro's fall. The global situation remains uncertain since both geopolitical problems and the coronavirus pandemic are still in force. All these facts are creating new disruptions in supply chains, which will surely negatively affect inflation in many countries.Today, in the first part of the day, only Member of the Executive Board of the ECB Philip Lane will provide a speech. In addition, Germany is planning to disclose data on its GfK consumer climate indicator. However, traders will hardly pay attention to the report. They are likely to focus on announcements made by ECB President Christine Lagarde. However, the euro will hardly reverse amid the speech. Recently, even the hawkish stance of the ECB has been failing to support the euro. During the US trade, traders will pay attention to such reports as goods trade balance, wholesale inventories, and pending home sales. Notably, all these reports are of minor importance and are unlikely to affect the greenback. Since the main trend is downward, it is better to bet on a further decline in the asset, following scenario 1.

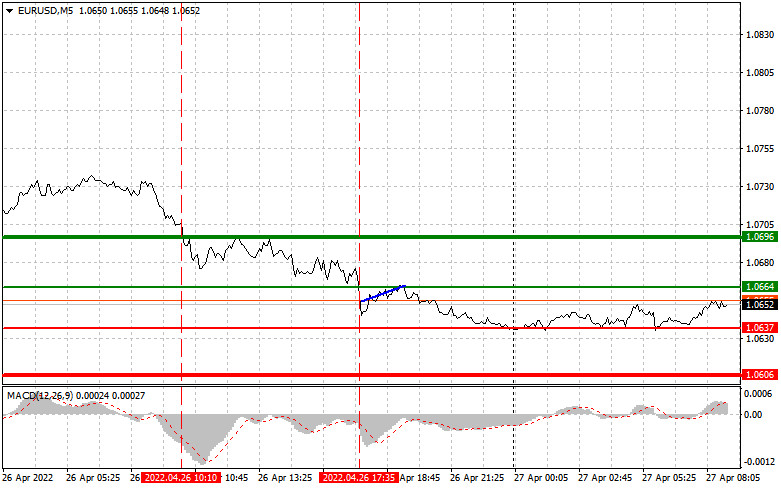

Buy signalsScenario 1: today, traders may consider long positions, if the price reaches the level of 1.0664 (a green line). The target is located at 1.0696, where it is recommended to close the position and open an opposite order, expecting a change of 20-25 pips. Today, the euro will hardly jump, but buyers will try to protect the lows recorded in 2020. Notably, before starting to buy the asset, make sure that the MACD indicator is above the zero level and begins upwardly moving from it.Scenario 2: it is also possible to buy the euro, if the price hits 1.0637. At this moment, the MACD indicator should be in the oversold area, thus limiting the downward potential of the pair and causing a reverse. In this case, the pair may climb to 1.0664 and 1.0696.

Sell signalsScenario 1: traders may think over sell order, if the price touches the level of 1.0637 (a red line). The target is located at 1.0606, where it is recommended to close the order and open an opposite position, expecting a change of 20-25 pips. Pressure on the euro may return at any time as the global situation is showing no signs of improvement and the Fed's policy will continue supporting the US dollar. Notably, before starting to sell the euro, make sure that the MACD indicator is below the zero level and begins dropping from it.Scenario 2: today, it is also possible to sell the euro, if the price reaches 1.0664. At this moment, the MACD indicator should be in the overbought area, thus capping the upward potential of the pair and causing the price reverse. The pair may drop to 1.0637 and1.0606.

What we see on the trading charts:

A thin green line is the entry price at which you can buy a trading instrument.A thick green line is the estimated price where you can place a take-profit order or lock in profits by yourself, since the price will hardly go above this level.A thin red line is the entry price at which you can sell the trading instrument.A thick red line is the estimated price where you can place a take-profit order or lock in profits by yourself, since the price is unlikely to decline further.The MACD indicator. When entering the market, it is important to take into account overbought and oversold zones.Beginning traders should be very cautious when making decisions to enter the market. It is better to open positions ahead of the publication of important reports in order to avoid price fluctuations. If you decide to enter the market amid the news release, place stop orders to minimize losses. Otherwise, you may lose all your funds, especially if you do not use money management and trade big volumes.Please remember that successful trading requires an accurate trading plan similar to the one described above. Knee-jerk decisions made amid the current market situation is a losing strategy of an intraday trader.