Analysis and tips on how to trade EUR/USD

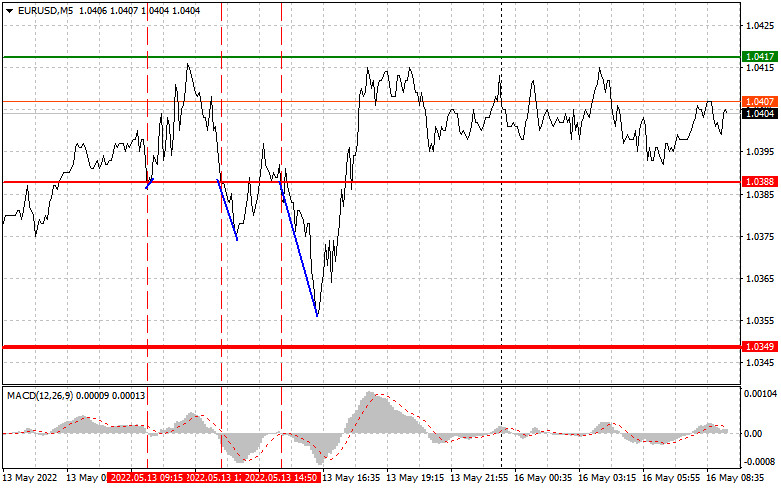

On Friday, the pair traded around 1.0388. The level was broken on the third try. Whenever the pair attempted to test the mark of 1.0388, the MADC moved down from the zero level, which created an excellent sell signal. However, the first signal was unprofitable and the second one brought just 10 pips of profit. After the third signal, the price fell by more than 30 pips So, the previous losses were offset and some profit was made. There were no more entry points on Friday.

France's and Spain's consumer price index came in line with economists' forecasts, which limited the pair's growth potential, especially in the wake of a bearish market a day earlier. ECB President Lagarde's speech had no effect on the market. Michigan consumer sentiment in the US exerted pressure on the dollar during the North American session. As a result, trades were closed and the pair skyrocketed. Today, during the European session, the focus should be on speeches by Fabio Panetta and Philip Lane, members of the Executive Board of the ECB. The officials favor faster rate hikes, which could boost the euro. The ECB is expected to announce the first rate increase as early as July. Today, the eurozone macroeconomic calendar contains such releases as the balance of trade for March and the European Commission spring forecast. They are unlikely to somehow affect the market. During the North American session, no important macro events are set to unfold. Therefore, traders should act based on Scenario 2 to buy the instrument. The Empire State Manufacturing index will be of little interest despite a possible decrease in figures. The speech of the Fed's John Williams will also be of secondary importance because the plans of the Federal Reserve are already clear.

Buy signal

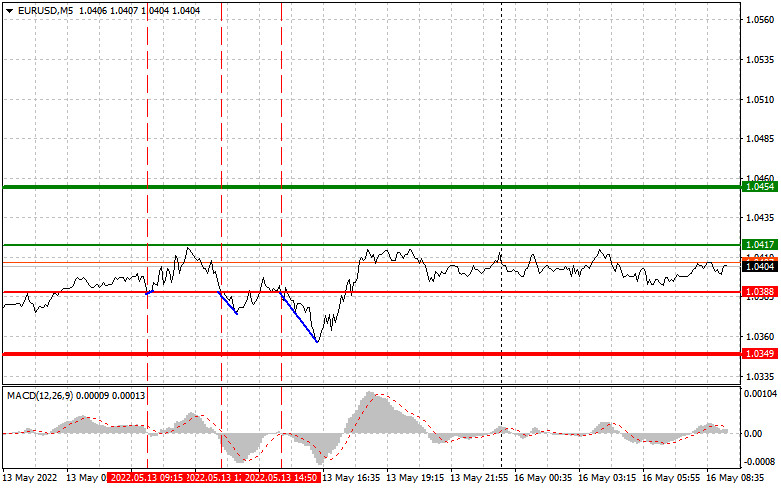

Scenario 1: Long positions could be opened today when the price reaches 1.0417 (the green line on the chart), with the target at 1.0454. Long positions could be closed around 1.0454 and the euro could be sold, allowing a 30-35 pips correction. The euro may show growth during the European session if macroeconomic data in the eurozone comes in strong and the ECB members are hawkish. Important! Before buying the instrument, make sure the MACD is above zero and just starts moving up from this level.

Scenario 2: Likewise, long positions could be opened today if the quote touches 1.0388 when the MACD is in the oversold zone. This could limit the pair's downside potential and lead to an upward reversal in the market. The price may head either towards 1.0417 or 1.0454.

Sell signal

Scenario 1: Short positions could be opened today when the price reaches 1.0388 (the red line on the chart). If so, the pair may go down to the target at 1.0349 where traders should consider closing their positions and buying the euro, allowing a 20-25 pips correction. Pressure on the euro could increase during the North American session if the Fed official again confirms the regulator's aggressive stance. Important! Before selling the instrument, make sure the MACD is below zero and just starts to move down from this level.

Scenario 2: Likewise, short positions could be opened today if the price hits 1.0417 when the MACD is in the overbought zone. This could limit the pair's upside potential and lead to a downward reversal in the market. The quote may go either to 1.0388 or 1.0349.

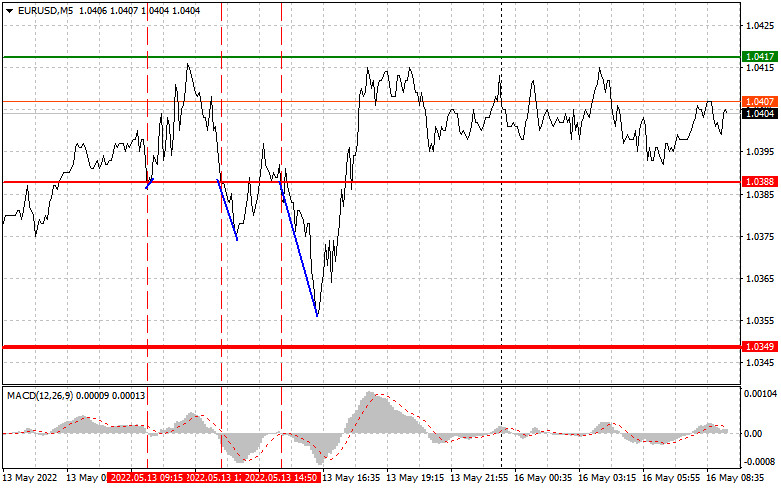

Indicators on the chart:

The thin green line indicates a buy entry point.

The thick green line is the estimated price where you should place a take-profit order or close positions manually since the quote is unlikely to grow above this level.

The thin red line indicates a sell entry point.

The thick red line is the estimated price where you should place a take-profit order or close positions manually since the quote is unlikely to fall below this level.

MACD. When entering the market, it is important to pay attention to the overbought and oversold zones.

Remember that novice forex traders should be very careful when deciding to enter the market. Before the release of important fundamentals, you should stay out of the market in order to avoid sharp fluctuations in the rate. If you decide to trade during news releases, make sure to always place a stop-loss order to minimize losses. Without it, you may quickly lose your entire deposit, especially if you do not use money management but trade large volumes.

Remember that in order to succeed in the market, you should have a clear trading plan, like the one I presented above. Spontaneous decisions based on the current state of the market are a losing strategy for an intraday trader.