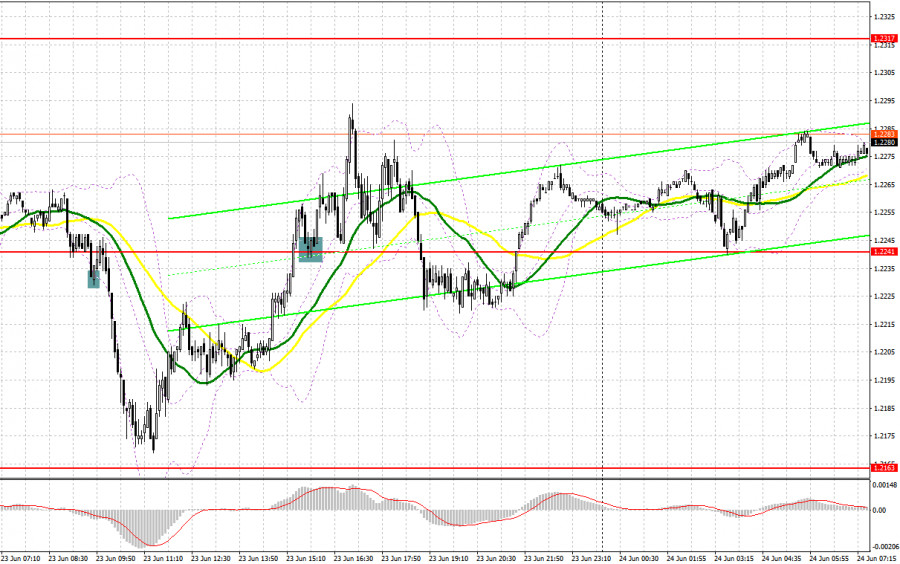

Yesterday, traders received several interesting signals to enter the market. Let's take a look at the 5-minute chart to shed light on the market situation. Earlier, I asked you to pay attention to the level of 1.2231 to decide when to enter the market. Data on the UK business activity was not as bad as we thought at first. However, it led to a sharp drop in the pound sterling. A false breakout of 1.2231 gave a buy signal, but traders suffered losses. The pair failed to hit 1.2163, thus preventing the formation of a long signal. In the second part of the day, bulls regained control over the resistance level of 1.2241, whereas its downward test led to a perfect buy signal. As a result, the pair climbed by more than 50 pips.

Conditions for opening long positions on GBP/USD:

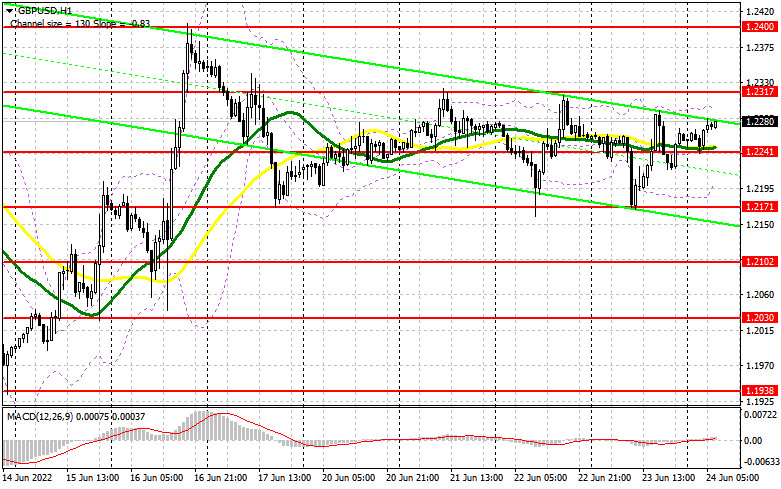

Data on the UK business activity almost met the forecast, which allowed the pound sterling to recoup all the previous losses. Comments made by Jerome Powell did not affect the pair. That is why the asset continued hovering within the sideways channel, keeping alive hope for an uptrend. Today, in the first part of the day, the UK will disclose its retail sales report, which may exert pressure on the British pound since forecasts are rather gloomy. Core retail sales figures and speech that will be delivered by MPC Member Haskel are unlikely to influence the market. That is why if bulls manage to protect 1.2241 in the first part of the day, the likelihood of a further rise will increase. If the pound/dollar pair declines, bulls will have to use all their forces to protect the middle of the sideways channel of 1.2241. Only a false breakout of this level will give a long signal with the target at 1.2317. This level is crucially important for bulls since the pair may resume rising if bulls regain control over it. A breakout and a downward test of 1.2317 will form a buy signal with the target at 1.2400. If the pair breaks this level, traders will receive one more buy signal with the target at 1.2452, where it is recommended to lock in profits. The next target is located at 1.2484. If the pair drops and bulls fail to protect 1.2241, pressure on the pair will surge. In this case, it will be possible to open long positions after a false break of the lower limit of the range at 1.2171. It is also possible to buy the asset from 1.2102 or lower – from 1.2030, expecting a rise of 30-35 pips.

Conditions for opening short positions on EUR/USD:

Bears are a bit puzzled since every attempt to push the pound sterling to the weekly lows results in purchases performed by big players. However, the pair may still resume falling. It is very important not to allow buyers to go above 1.2317. A false breakout of this level after the UK retail sales data may lead to a perfect sell signal with the target at 1.2241. A breakout of this intermediate level may cause a sell-off and return the pair to the lower limit of the range. Only settlement below 1.2241 and an upward test will give a sell signal with the target at 1.2171, where traders should partially lock-in profits. The next target is located at 1.2102. The test of this level will point to bulls' defeat. If the pound/dollar pair increases and bears fail to protect 1.2317, only strong data from the US may give a sell signal.In addition, a false break of the resistance level of 1.2400 will form a good entry point for sellers. If bears fail to protect 1.2400, the pair may jump, thus affecting sellers' stop orders. In this case, short orders could be delayed until the price hits 1.2452. There, it will be better to go short after a false breakout. If the pair goes beyond this level, demand for the pound sterling will rise. Short orders could also be initiated from 1.2484 or higher – from 1.2516, expecting a decline of 30-35 pips.

COT report

According to the COT report from June 14, the number of both long and short positions dropped. The pound sterling gained in value after the BoE's meeting. The regulator said that it would continue following its plan to combat high inflation. The rise in the currency is likely to affect the next COT report. Big players are benefiting from the situation and buying a cheap pound, regardless of the negative economic factors. However, the pair is unlikely to recover in the near future since the Fed's policy will considerably prop up the greenback against risk assets. The COT report unveiled that the number of long non-commercial positions dropped by 5,275 to 29,343, whereas the number of short non-commercial positions decreased by 10,489 to 94,939. As a result, the negative value of the non-commercial net position slid to -65,596 from -70,810. The weekly closing price decreased to 1.1991 against 1.2587.

Signals of indicators:

Moving Averages

Trading is performed around 30- and 50-day moving averages, which points to the market uncertainty.

Note: The period and prices of moving averages are considered by the author on the one-hour chart that differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

In case of a rise, the area of 1.2310 will act as resistance. If the pair drops, the support level will be located at the lower limit of the indicator - at 1.2215.

Description of indicators:

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions is a total number of long positions opened by non-commercial traders.

- Short non-commercial positions is a total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.