The EUR/GBP cross-pair tested a two-month low today, falling to the base of the 84th figure. And although buyers then regained intraday losses, the downward trend is still in force. The euro failed to reverse the pair: the price has been actively and consistently declining throughout the week. We cant say that the pound is in better shape now, but compared to the euro, it is in an advantageous position.

Today's downward momentum is due to the release of data on the growth of the UK economy. All components of the report unexpectedly came out in the "green zone," contrary to the pessimistic forecasts of most experts. Recall that previous releases on the country's GDP growth reflected negative trends, putting significant pressure on the pound. Market participants were quite justifiably worried that the Bank of England would slow down the pace of monetary policy tightening or even put this process on pause if the situation continued to worsen. Therefore, today's report partially leveled such experiences.

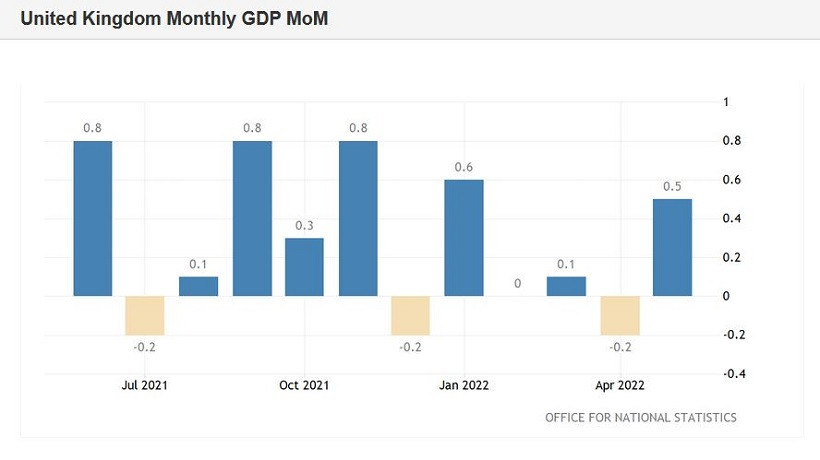

After the April recession, the UK economy has moved to growth. The gross domestic product grew by 0.5% in May after a 0.2% decline in April. At the same time, most analysts predicted a decrease in this indicator in the negative area, to the level of -0.2%. In quarterly terms, growth was also recorded to 0.4%, while experts expected to see this component at zero in May. On an annualized basis, the volume of GDP increased by 3.5% (forecast – 2.7%). The results exceeded the expectations of most experts, but, on the other hand, such dynamics is largely due to temporary factors.

The structure of the release suggests that two factors primarily contributed to the growth of the British economy: increased demand for travel agency services due to the holiday season and increased demand for medical services. And if everything is clear with the holiday season, then the excitement around the medical sphere can be associated with the coronavirus. An increase in infections was observed in the UK since April, while more than 250,000 new cases were recorded in May.

And yet, despite some contradictory nuances of today's release, the report itself supported the British pound. The renewed growth of the UK economy will allow the Bank of England to focus on combating high inflation. Whereas earlier, there were often suggestions that the regulator would pause the process of tightening monetary policy, fearing a further decline in the country's economy. Moreover, one of the Committee members, Jon Cunliffe, openly called for a break: back in spring, he voted against raising the interest rate.

Today the situation has changed. Representatives of the English regulator voice mainly hawkish rhetoric, focusing their attention on the problems of high inflation. Bank of England Chief Economist Huw Pill, in particular, said at the end of last week that he was ready to support "a faster pace of policy tightening, if necessary." Another representative of the British Central Bank, Catherine Mann, also made a hawkish statement. Mann said the uncertainty regarding the inflationary process "strengthens the arguments in favor of an early increase in interest rates."

Recall that at the last meeting, three members of the Bank of England, Michael Saunders, Catherine Mann, and Jonathan Haskel, voted "in favor" of raising the rate by 50 basis points. But they remained in the minority, as the other six of their Committee colleagues insisted on a 25-point increase. It is likely that after today's release, the balance of power will change in favor of the representatives of the hawk wing.

Meanwhile, the European Central Bank still doubts the advisability of a 50-point rate hike at the September meeting. At the July meeting, the central bank will increase the rate by 25 points—this is already a question, one might say, resolved—while further prospects are the subject of discussion. The worsening energy crisis is forcing ECB members to consider recession risks when discussing the pace of monetary tightening. In this regard, the Bank of England is more flexible than the European Central Bank.

Given the prevailing fundamental background for the EUR/GBP, it is not surprising that the cross has dipped by more than 250 points over the past week. And today, the downward trend is still in force, so corrective upward pullbacks can be used to open short positions.

From a technical point of view, the EUR/GBP pair tested the support level of 0.8420 today, which is the lower line of the Bollinger Bands indicator on the daily chart. It is advisable to enter sales only after fixing below this target. In this case, the price will be under all the Bollinger Bands lines, as well as under all the lines of the Ichimoku indicator (including the Kumo clouds), which will form a bearish Parade of Lines signal. The main target of the downward movement will be the level of 0.8300, which is the bottom line of the Bollinger Bands on the monthly chart.