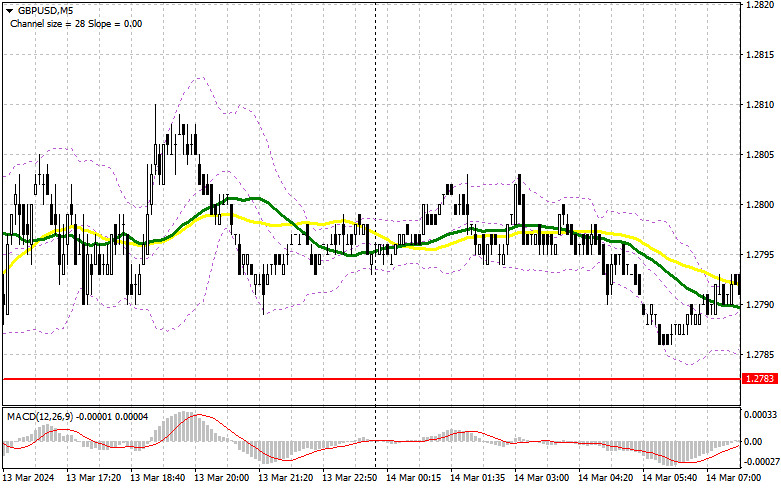

Yesterday, GBP/USD generated only one signal to enter the market. Let's take a look at the 5-minute chart and analyze the market situation. In my previous forecast, I paid attention to the level of 1.2808 and planned to make decisions on entering the market from it. The growth and a false breakout there a signal to sell the pound, but GBP/USD did not develop any downward movement. In the afternoon, it was not possible to detect suitable entry points into the market.

What is needed to open long positions on GBP/USD

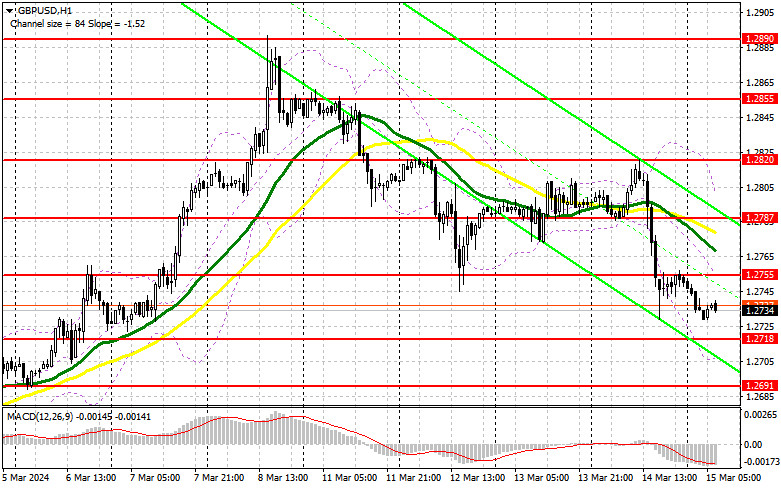

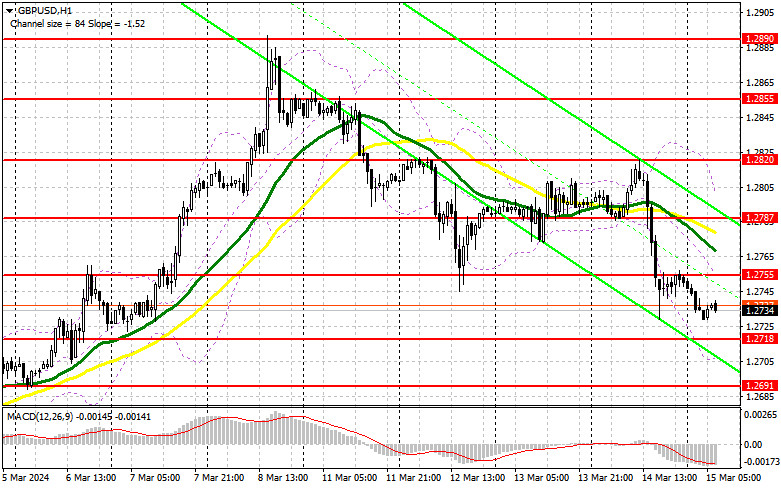

The pound has weakened against the US dollar, but everything is still happening as a downward correction. However, a new downtrend is likely to come into being soon. Data on growth in US retail sales and a sharp jump in producer prices in February this year encouraged strengthening of the US dollar. Indeed, such strong data pushed back the Federal Reserve's plans to cut interest rates, which plays against risky assets. There are no UK statistics available today, so buyers may continue to struggle. For this reason, you need to act very carefully. In case of a decline in GBP/USD, only a false breakout at about the nearest support 1.2718 will provide a suitable entry point into long positions in the hope that demand for the pound will return. The bulls anticipate updating 1.2755, new resistance, where buyers are likely to face serious problems. A breakout and consolidation above this level will strengthen the position of the bulls and open the way to 1.2787, where the moving averages are located, playing on the side of the bears. The farthest target will be a high of 1.2820, where I am going to take profits. In the scenario of a decline in GBP/USD and lack of activity on the part of the bulls at 1.2718, the instrument will continue its fall, which will lead to a bear market. In this case, only a false breakout in the area of the next support 1.2691 will confirm the correct entry point into the market. I plan to buy GBP/USD immediately on a dip from the low of 1.2666, bearing in mind a correction of 30-35 pips within the day.

What is needed to open short positions on GBP/USD

The bears did everything in their power and brought the market back under their control. Today, a false breakout in the resistance area of 1.2755 will confirm the correct entry point to sell in the continuation of the trend, which will push the price down to 1.2718. A breakout and reverse test from bottom to top of this range will deal another blow to the positions of the bulls, leading to the activation of stop orders and opening the way to 1.2691. I expect large buyers to show up there. The lowest target will be the area of 1.2666, where they will take profits. If GBP/USD grows and there is no activity at 1.2755, buyers will again feel the strength in anticipation of a small upward correction. In this case, I will postpone short positions until a false breakout at the level of 1.2787, where the moving averages are located. If there is no downward movement even there, I will sell GBP/USD immediately during a rebound from 1.2820, but only in anticipation of a downward correction by 30-35 pips within the day.

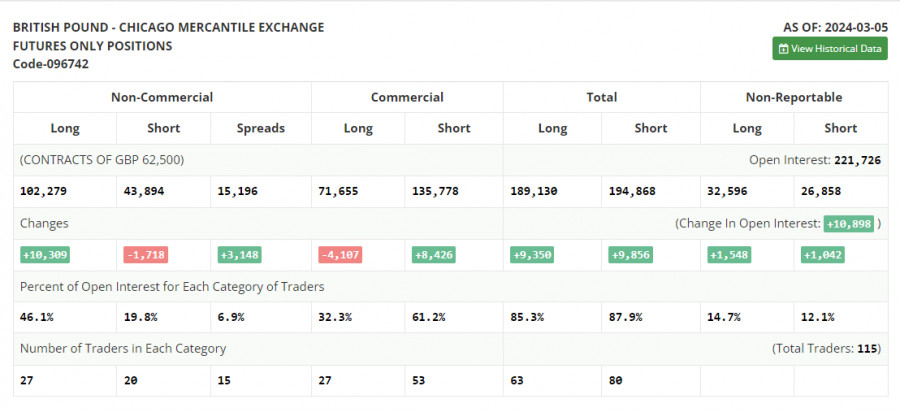

In the COT (Commitment of Traders) report for March 5, there was an increase in long positions and a decline in short positions. Despite the latest inflation data and statements from Bank of England officials that interest rates could be cut even if inflation does not reach the target of 2.0%, traders are adding long positions on GBP/USD. This may be due to the dovish position of the Federal Reserve. This week's inflation data may strengthen market expectations that the FOMC will soon resort to cutting interest rates, which should weaken the US dollar's position, boosting demand for the British pound, which has tumbled in recent years. The latest COT report said that long non-commercial positions rose by 10,309 to 102,279, while short non-commercial positions decreased by 1,718 to 43,894. As a result, the spread between long and short positions grew by 3,148.

Indicators' signals

Moving averages

The instrument is trading below the 30 and 50-day moving averages. It indicates a further decline in GBP/USD.

Note: The period and prices of the moving averages are considered by the analyst on the 1-hour chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

In case GBP/USD goes down, the indicator's lower border at about 1.2718 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.