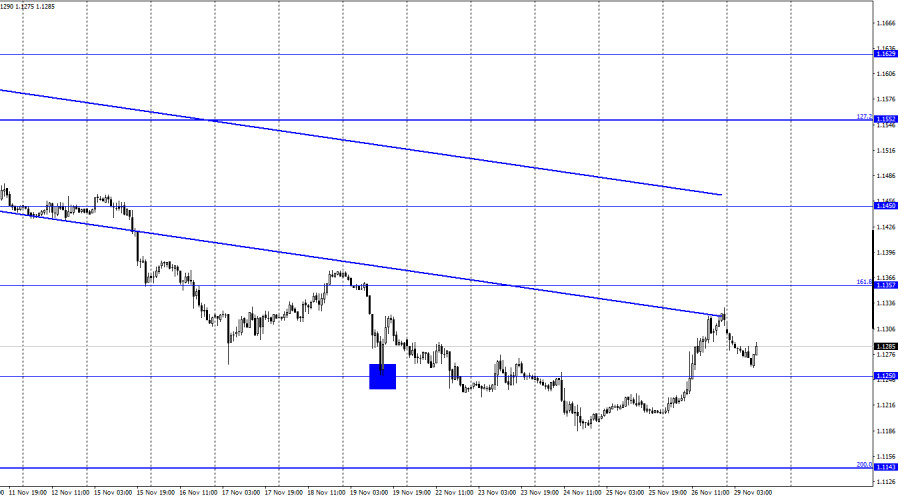

EUR/USD – 1H.

Hello, dear traders! The EUR/USD pair continued to rise on Friday and closed above 1.1250. Consequently, by the end of the day the quotes almost reached the 161.8% correction level at 1.1357. However, on Monday the European currency started declining. The movements of these two days should be discussed in detail. Notably, the markets are focused only on the new Omicron variant. The reason for a panic is unclear as it is not the first case of the new COVID-19 variant. Moreover, each time the doctors have stated that the new variant is more contagious and dangerous to humans than all the previous ones. Thus, there is nothing special about it yet. For example, the whole world is currently at the grip of a very dangerous delta variant. Besides, vaccines do not equally protect against possible infection with any virus variant. They only reduce the likelihood of complications.

Friday's strong rise in the European currency could have been related to the news about the new variant. Besides, it would have made more sense if the dollar had continued to grow as a reserve currency. However, the euro, considered more risky, was rising. Moreover, in any complex situations traders dispose of risky assets. Therefore, maybe the stock market or other markets reacted to the omicron variant late last week. However, the currency market did not. The euro started falling overnight on Monday, which could be a simple correction to Friday's move, or it could be a delayed reaction to Omicron. Thus, now it is quite difficult to figure out why the EUR/USD pair is rising or falling. Traders get really worried now and may make hasty or even panic decisions. However, I believe the situation will improve, and markets will calm down very soon. By the way, the scenario of the dollar's fall on Friday looks much more real due to traders' downturn in sales as previously the rise of the dollar was observed during several weeks. Therefore, it was necessary to fix some profits on deals.

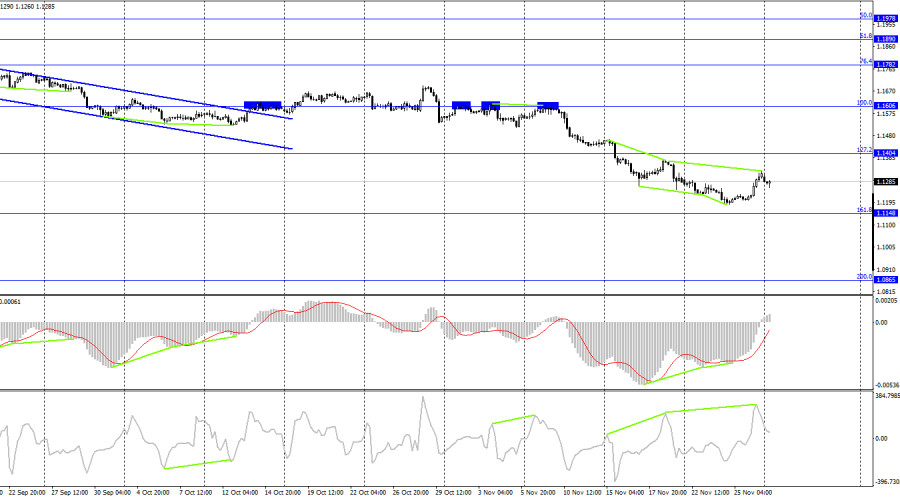

EUR/USD – 4H

On the 4-hour chart, the pair performed a reversal in favor of the euro after formation of the second bullish divergence of the MACD indicator and some growth towards the 127.2% Fibo level at 1.1404. However, a new bearish divergence in CCI indicator allows traders to expect a reversal in favor of the US currency and a further fall towards the 161.8% correctional level at 1.1148. If this divergence fails, then the rise can continue.

US and EU economic news calendar:

EU - ECB President Christine Lagarde will deliver a speech (17-15 UTC).

US - Chairman of the Board of Governors of the Federal Reserve System Jerome Powell will make a speech (20-05 UTC).

On November 29, Christine Lagarde and Jerome Powell will speak in the EU and US. They will possibly mention the new COVID-19 variant. In any case, their speeches are always exciting, though in most cases irrelevant. I consider the information backdrop will be weak today.

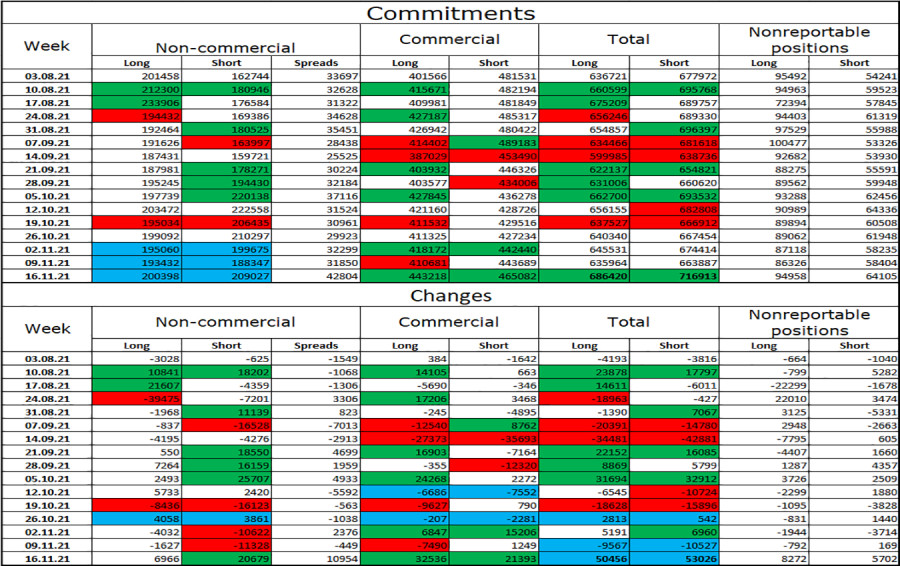

COT report (Commitments of traders):

The latest COT report showed that the sentiment of non-commercial traders became more bearish during the reporting week. Speculators opened 6,966 long euro contracts and 2,679 short contracts. Consequently, the total number of long contracts held by speculators has grown to 200,000, and the total number of short contracts has risen to 209,000. These figures almost coincide for the third week in a row, indicating that speculators do not have a clear mood. However, in general, in recent months there has been a tendency of strengthening bearish sentiment. Therefore, I conclude that traders' sentiment is now at a point where neither bulls nor bears have an advantage. However, at the same time the European currency continues falling, so the trend of strengthening the bearish sentiment among major players is evident.

EUR/USD forecast and recommendations for traders:

I recommend new sales of the pair at closing under the level of 1.1250 with a target of 1.1148. It is possible to buy the euro as closing above 1.1250 on the hourly chart with a target of 1.1357 has been completed. Currently, they can still be held open.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for ensuring current activities or export-import operations.

"Non-reportable positions" - small traders who have no significant influence on the price.