Analysis of previous deals:

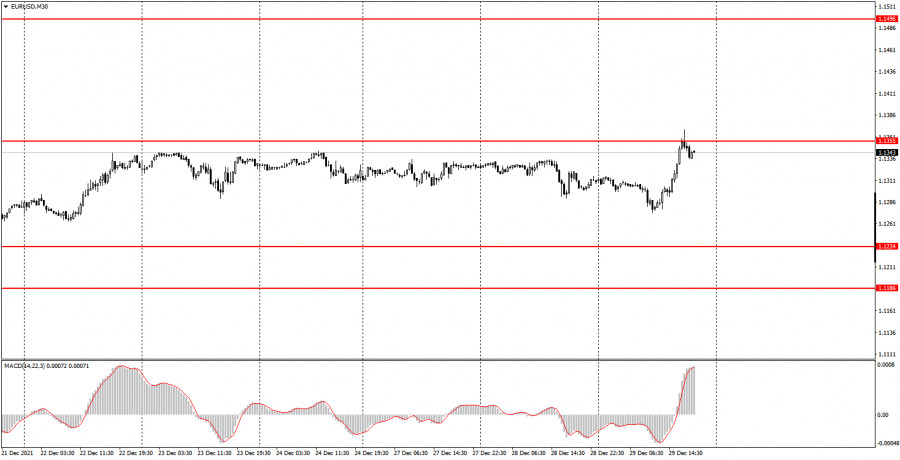

30M chart of the EUR/USD pair

The EUR/USD pair continued to remain inside the horizontal channel on Wednesday, which does not even need to be named: it is perfectly visible in the chart above. Nevertheless, the pair had a really real chance of leaving this channel today. The movement shown by the pair today was quite strong, almost 100 points from low to high. Thus, if it did not begin in the middle of the channel, but closer to the upper border, then there is no doubt that traders would have been able to settle above it. And so the price once again rose to the upper border of the 1.1355 horizontal channel and bounced off it. Despite the fact that today there was quite a strong volatility, the EUR/USD pair still remains inside the horizontal channel. No important statistics released either in the United States or in the European Union. Thus, for quite a long time novice traders have nothing to even turn their attention to in terms of macroeconomic or fundamental information.

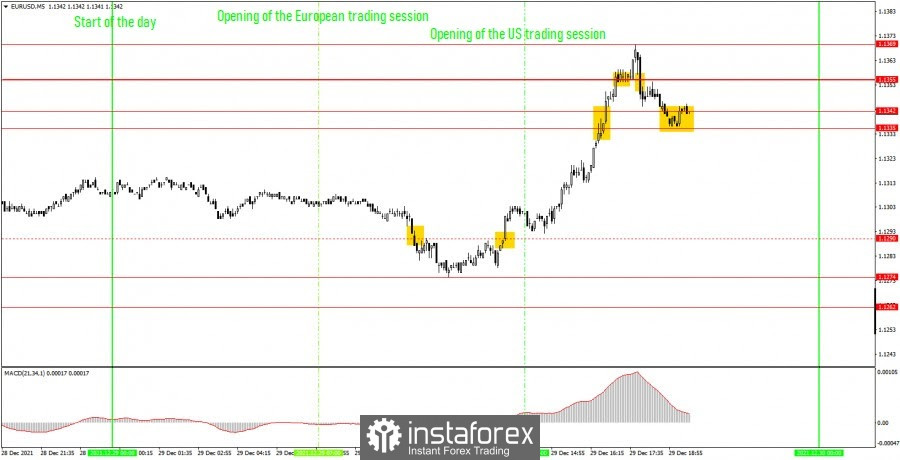

5M chart of the EUR/USD pair

The movement also looks pretty impressive on the 5-minute timeframe. Since the volatility was quite high today, it is not surprising that a large number of trading signals were generated. It remains only to figure out how and which should be worked out. However, let us first clarify that the 1.1290 level at the end of the day lost its relevance, and instead, a level of 1.1274 was formed (the low of the day). The 1.1369 level (high of the day) was also added. The first sell signal was generated when the price settled below the level of 1.1290. Newcomers could open short positions in this place, but the price was unable to continue moving down for a long time and even failed to pass 15 points. Thus, after the price settled above the level of 1.1290, short positions should have been closed manually. The loss was 14 points. In the same place, it was necessary to open long positions on a buy signal. The price subsequently went up by about 70 points, breaking through the levels of 1.1335, 1.1342 and 1.1355 along the way. This was enough for any Take Profit to work (30-40 points). It was also possible to exit the deal manually after consolidating below the level of 1.1355. It was even possible to open a new short position, as a sell signal was formed near the level of 1.1355, but it was not possible to earn much on it. Thus, novice traders could have earned no less than 30 points on Thursday trades. Not bad at all, as for December 29th.

How to trade on Thursday:

The trend is absolutely sideways on the 30-minute timeframe, although today the pair had all the chances to complete it. But until the price settles above the level of 1.1355, the flat will remain. Since at the moment the EUR/USD pair bounced off this level, it is reasonable to speak about a new round of the downward movement with 1.1234 as the target. However, if the pair still manages to overcome the level of 1.1355, then the upward movement will be able to continue with the target of 1.1496 and an upward trend will be formed. On the 5-minute timeframe, there are, of course, more levels, but some of them are located quite close to each other, so they should be considered as areas of support or resistance. In particular, we recommend trading at the levels of 1.1274, 1.1335-1.1342, 1.1355, 1.1369 and 1.1422 tomorrow. It is possible that the volatility on December 30 will also be quite good, because the markets have found grounds for active trading today! We also remind you that for any trade you should set Take Profit 30-40 points and Stop Loss at breakeven after passing 15 points in the right direction. The deal can also be closed manually near important levels or after the formation of an opposite signal. As for fundamental events and macroeconomic statistics, nothing interesting is planned for tomorrow.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.