Wage negotiations in Germany's public sector, covering about 2.5 million workers, led to an agreement, according to which the average wage growth should increase by 11.5% over a period of 24 months. The agreement directly contributes to supporting high inflation in the eurozone, as the public sector is not the only area affected - the Verdi trade union has started similar negotiations for a 15% wage increase in the retail sector, covering another 2.6 million workers. It is not difficult to guess that this trend could easily spread to other sectors in Germany and other eurozone countries.

Instead of an expected improvement from the Texas Manufacturing Business Conditions Index, it fell from -15.7 points to -23.4 points, reaching the lowest value in 9 months, supporting similar negative reports from other regional Federal Reserve offices. The sub-indices for new orders and shipments remained in negative territory, while the wage index rose by 7 points to 37.6 points, significantly higher than the average level of 21 points and a direct factor fueling inflation. The future general business activity index fell even lower, dropping from -11.2 to -16.6, meaning that the Texas manufacturing sector sees further deterioration.

A report from First Republic Bank (FRB), which narrowly avoided bankruptcy in the first quarter, showed that deposit outflows in Q1 amounted to 41% of the total deposit base. Bankruptcy was avoided through a set of emergency measures, including emergency lending from the Fed and major banks at an average rate of 4.8%, while FRB's own loans were issued at 3.73%, which will lead to an increase in losses in the future. The banking crisis, which seemed to have been averted, has actually only lain dormant.

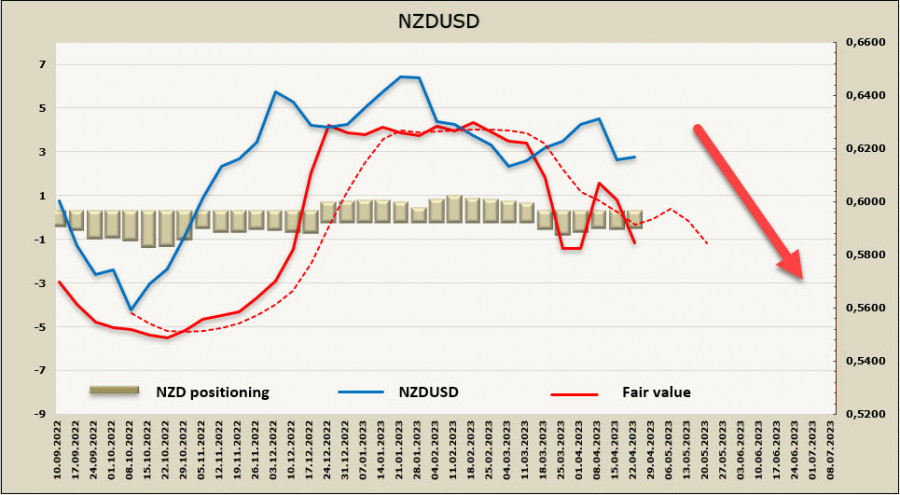

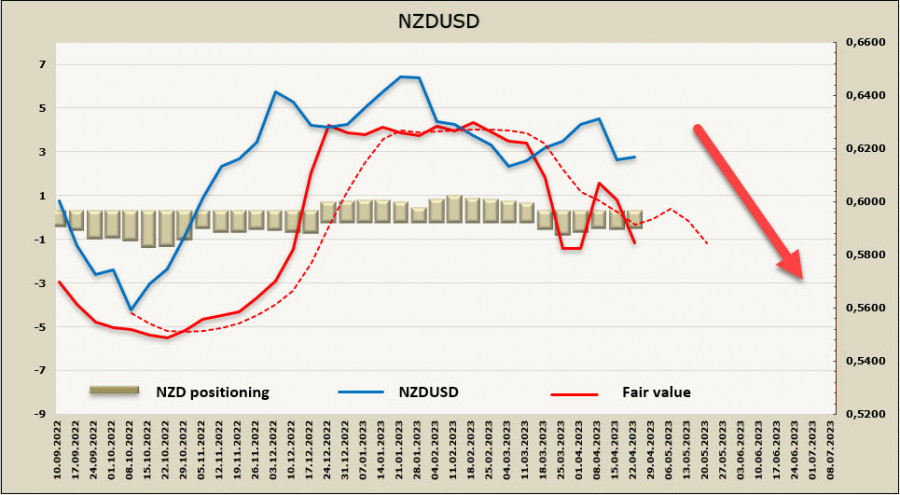

NZDUSD

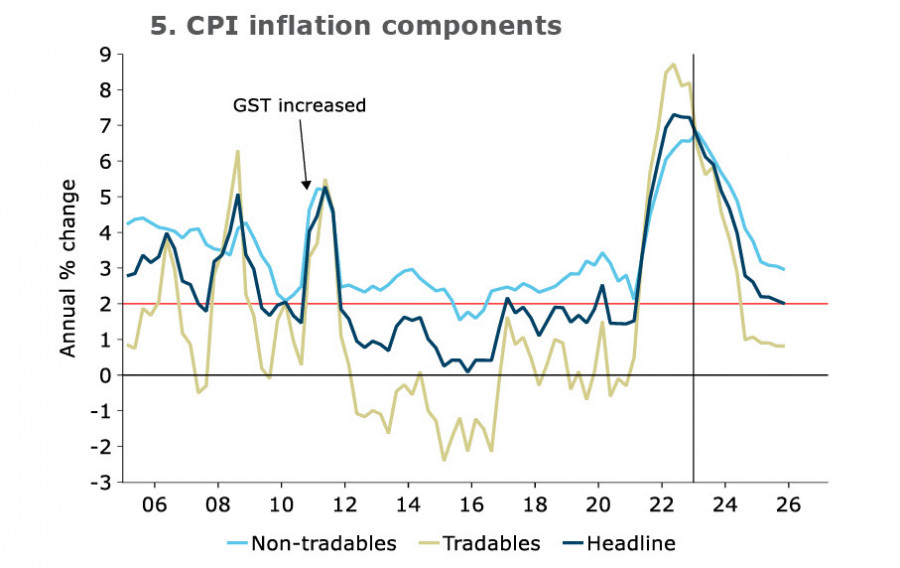

Consumer inflation fell in Q1 from 7.2% to 6.7% YoY, significantly lower than the 7.1% forecast, suggesting that overall inflation in 2023 could also be lower than projections. For Q2, BNZ Bank predicts 6.3%, lower than the Reserve Bank of New Zealand's (RBNZ) February forecast of 6.6%, and for the whole of 2023, ANZ sees inflation at 4.7%, down from the previous forecast of 5.3%.

Markets reacted to the decline by selling off the NZD, as forecasts for further RBNZ activity were revised. At present, achieving the target rate of 2% is expected by the end of 2025.

On Wednesday, New Zealand's foreign trade report for March will be published. The current account deficit is growing rapidly, and the trade balance deficit is expected to be $1.417 million, up from $714 million in February, increasing the annual deficit to $16.47 billion from $15.64 billion. Import growth is projected at 8%, while export decline is expected at 4%, primarily due to lower export prices, adding further pressure on the kiwi.

Overall, the data suggest that a recession is arriving in New Zealand. The REINZ housing market data for March generally matched the weak market, with sales remaining at a low level. High uncertainty was also reflected in a sharp increase in the number of migrants (+11,655 people in March), which, on the one hand, will increase demand for goods and services, but also increase the labor supply in the job market, potentially slowing wage growth. If the flow of migrants remains high, the risks of a recession will decrease, but the pace of inflation reduction will slow down, forcing the RBNZ to maintain high interest rates for a longer period, which will slow down economic growth.

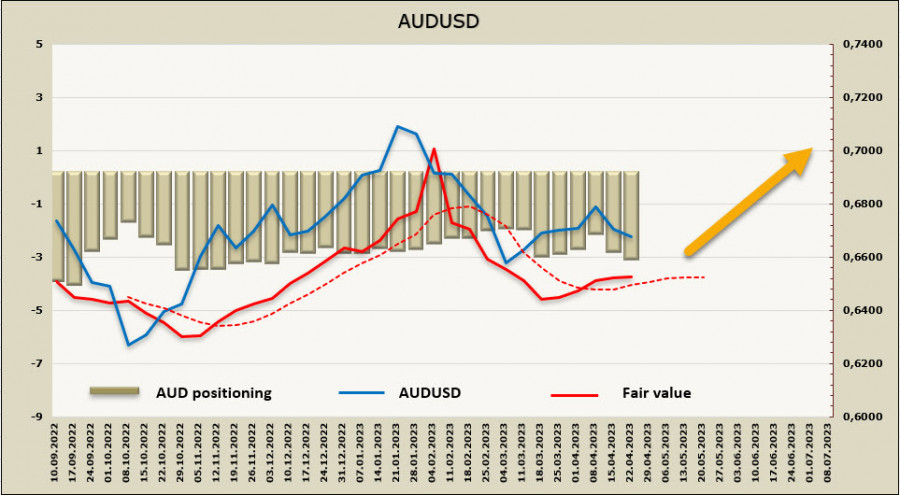

On Wednesday, key consumer inflation data for the first quarter will be published. It is expected that the data will confirm the preliminary conclusion that the inflation peak occurred in the 4th quarter of last year, with inflation slowing from 7.8% to 7.0%. The main intrigue lies in the dynamics of core inflation since the energy component is known to decrease. Core inflation better reflects internal rather than external components of overall inflationary pressure, and the Reserve Bank of Australia's stance will largely depend on this data. Recent RBA minutes confirmed that the bank has already changed its schedule for returning to the 2-3% target range, with the return to this range taking longer than the February forecast of mid-2025. Inflation data in line with forecasts will give the RBA a chance not to raise rates at the upcoming meeting, which will increase bearish pressure on AUD.

Attention should also be paid to the release of private sector credit data on Friday; credit growth above forecasts will also increase the chances of the RBA raising the rate by 0.25% in May.

Positioning for AUD is consistently bearish, with the net short position increasing by 324 million to -2.848 billion. However, the calculated price has moved up due to more favorable yield dynamics for the aussie.

The previously indicated target of 0.6808 was not reached, since the bullish momentum was weaker than expected. The nearest support is at 0.6640/50, where the price is likely to stop falling and an attempt to turn upwards may occur. If the channel boundary does not hold, the scenario will be canceled, and AUD is more likely to continue its decline.

The net short position for NZD was adjusted by 35 million to -242 million, with speculative positioning being moderately bearish and the calculated price turning downwards.

NZDUSD has fallen to the middle of the 0.6130/40 channel, as we had anticipated in our previous review. While a week earlier the likelihood of a resumption of growth seemed quite high, as of today, the chances of a continued decline have increased. We assume that a decline to the local low of 0.6079 could be realized in the short term, with the next target being the channel limit of 0.5930/50.