The US inflation report turned out to be quite controversial. Almost all its components came out in the "green", proving to be stronger than forecasts. At the same time, core inflation still demonstrated a downward trend, despite a slower pace of deceleration. This caught market participants off guard: traders simply did not know how to react to the report. Initially, prices sharply dropped towards the 9-figure mark, but a downward phase did not start. Then buyers took the initiative, pushing the price up to the 1.0945 level. However, they could not hold on to their positions, as the inflation report ultimately worked in favor of the US dollar.

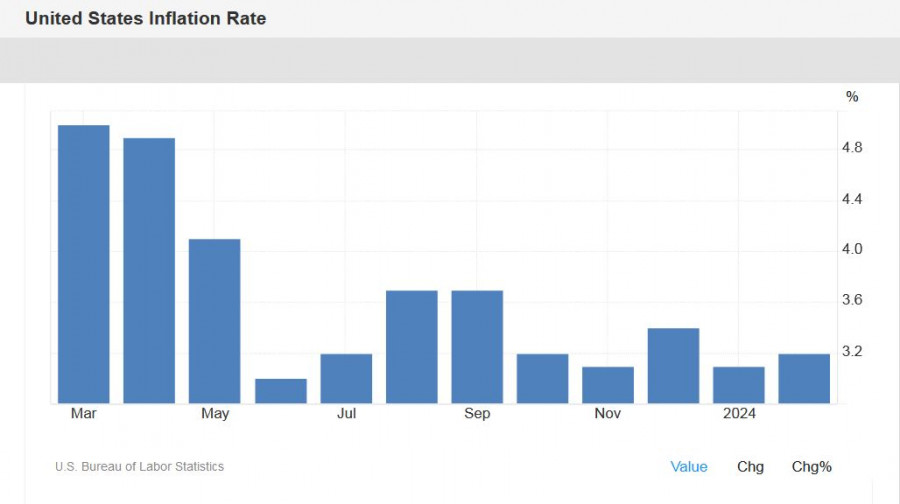

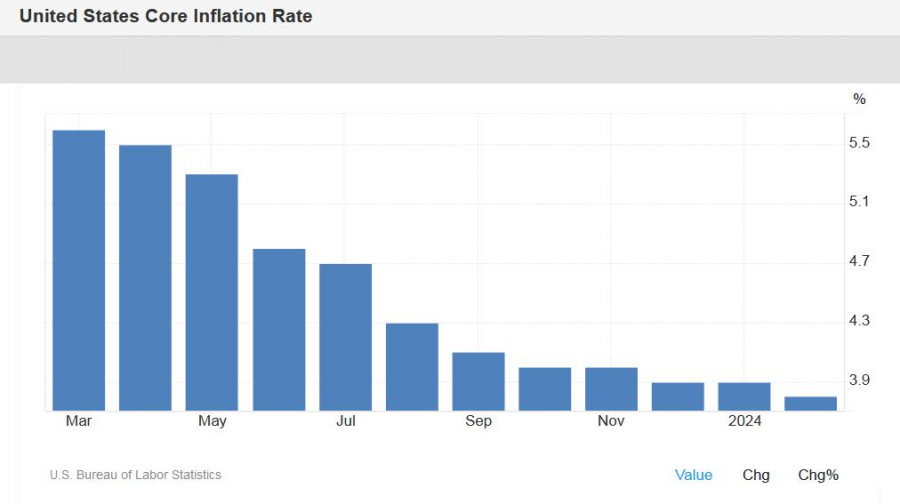

The Consumer Price Index (CPI) increased 0.4% for the month (the highest value since September 2023). This component of the report has been rising since November 2023. In annual terms, the CPI was expected to decrease to 3.0% (the lowest value since June 2023), but instead, it rose to 3.2%. The core index, excluding food and energy prices, was expected to edge down to 0.3% on a monthly basis, but it remained unchanged at 0.4%. In annual terms, the indicator decreased to 3.8% (the lowest value since June 2021), but the pace of decline slowed (experts predicted a more significant decrease to 3.7%).

The structure of the report indicates that energy prices in the United States decreased by 1.9% in February (gasoline saw the most significant decline, down by 3.9%). However, the pace of decline in energy prices slowed – this component decreased by 4.6% in January. Clothing prices remained unchanged (a 0.1% increase was recorded in the previous month), and the cost of used cars decreased by 1.8% (in January, a decline of 3.5% was recorded). The growth rate of food prices slowed from the January value of 2.6% to February's 2.2%, new cars became cheaper by 0.4% (in January -0.7%), and medical care goods decreased by 3% (January - 2.9%).

First of all, the inflation report was a pleasant surprise for dollar bulls, a "ray of light" against the backdrop of a dark streak. The events of the past two weeks have clearly not worked in favor of the greenback. For instance, in early March, the ISM Manufacturing Index disappointed. The indicator had been rising actively for the last two months (rising from 46 to 49 points), and according to forecasts, it was expected to return to the expansion point in February. Instead, it decreased to 47.8, reflecting a deterioration in the situation.

In addition, the rhetoric of Federal Reserve Chair Jerome Powell disappointed dollar bulls. Powell said that the central bank would not delay interest rate cuts this year. "If the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year," Powell said. What does this mean? Primarily, this means if the economy evolves on a disinflation path. The Nonfarm Payrolls report for February, published the day after Powell's speech, reflected an unexpected increase in unemployment and a slowdown in the growth rate of average wages. These fundamental factors (Powell's dovish comments + mixed Nonfarm Payrolls) undermined the dollar's positions, including against the euro.

The latest inflation report has somewhat altered the fundamental picture. Doubts are arising - will the necessary conditions for easing monetary policy be created in the foreseeable future? Inflation (especially the overall figure) has shown resilience once again, as if playing into the hands of dollar bulls. All these uncertainties work in favor of the greenback.

However, as we can see, dollar bulls are in no hurry to celebrate. For several reasons. Firstly, the core CPI continues to fall slowly but steadily, albeit at a slower pace. The core Personal Consumption Expenditures (PCE) index, which has been consistently declining for the past 6 months, also demonstrates a similar trend.

Secondly, the latest report has not shifted market expectations regarding the Federal Reserve's future course of actions. According to the CME FedWatch Tool, the probability of a rate cut in March is at 0.5%, at 10% in May, and 62% in June. This means that the market still believes that the Fed will maintain the status quo at the next two meetings, but there is more than a 50% confidence that the central bank will start easing monetary policy at the June meeting.

Thus, the dollar received some support but failed to turn the situation entirely in its favor. Sellers prevented buyers from approaching the 1.10 level but not beyond. There still isn't enough strength to restore the downward trend.

You should only consider short positions if the pair falls back below the 1.0890 level (the Tenkan-sen line on the daily chart). This target served as a price barrier during the upward movement, and now it will act as support. If the price breaches this level, the next targets would be around 1.0850 and 1.0800. However, as we can see, EUR/USD buyers are currently staying within the range of the 0.9 level, indicating the bears' weakness and how unreliable short positions are.